Payments

Financial Tools

Process Automation

Risk & Compliance

-

Payment Methods

-

Bank Account Connectors

-

Payment Automation

-

Risk Management

-

Cross-Border Payments

-

Accounting Integrations

-

AR/AP Automation

COMING SOON -

KYC/AML

COMING SOON -

Payment Links

-

Virtual Accounts

-

Approval Workflows

-

Onboarding

-

Open Data Payments

COMING SOON -

Ledger Management

-

Payment Verification

-

Transaction Monitoring

COMING SOON

Organizations

-

Blog

-

About VoPay

-

Case Studies

-

Careers

-

Newsroom

-

Contact Us

-

Knowledge Hub

NEW -

FAQ

Learn

Company

- Products

Process Automation

-

Payment Automation

-

AR/AP Automation

COMING SOON -

Approval Workflows

-

Payment Verification

- Solutions

- Developers

- Partners

- Resources

Real-Time, Secure Payment Verification Solutions

VoPay Verify™ confirms the legitimacy of recipients and payment details before funds are sent. Whether paying to a bank account, Interac e-Transfer email, or cardholder, our verification solution helps reduce fraud, prevent payment errors, and support compliance.

Accelerate onboarding, avoid failed transactions, and maintain trust in every payment your platform processes.

How Each Verification Method Works

Each verification tier is designed to match different levels of risk tolerance, from simple validation to rich recipient insights.

Bank Account Verification

Instant Bank Verify connects directly to the recipient’s online banking to confirm their name and address in real time. It’s fast, secure, and ideal for automated onboarding.

Micro- Deposit Bank Verification sends a small deposit to the recipient’s account, which they manually confirm. It’s best for recipients without online banking or when manual validation is preferred.

Interac e-Transfer® Verification

Basic Interac e-Transfer Verification checks that the recipient’s email is registered with Interac e-Transfer and matches the provided name.

Enhanced Interac e-Transfer Verification adds more context, returning detailed recipient data like account readiness and risk indicators, helping you make smarter payment decisions.

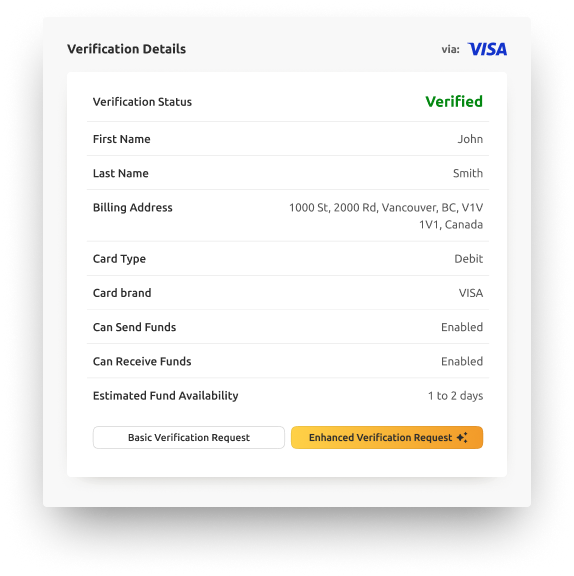

Card Verification

Basic Card Verification confirms the cardholder’s name and billing address to validate identity and reduce fraud.

Enhanced Card Verification goes a step further by including additional recipient information, giving you deeper insight into the legitimacy of each transaction.

Use VoPay Verify™ Instant Account Verification to Prevent Fraud & Failures

Verify In

Real-Time

Verify In Real-Time

Bank accounts, Interac emails, and cardholders can all be verified in under 3 seconds, keeping your payment flow fast while reducing risk.

Multi-Method

Coverage

Multi-Method Coverage

One solution for verifying bank accounts, Interac e-Transfers, and card payments. Select from Basic or Enhanced tiers to match your risk and compliance needs.

Flexible Access &

Integration

Flexible Access & Integration

VoPay Verify™ is available via API, and VoPay Portal. Easily enable, configure, and monitor your verification flows without heavy development work.

Built-In Fraud

Protection

Built-In Fraud Protection

Stop bad data before it becomes a failed payment. Our tools help platforms reduce chargebacks, NSFs, and manual intervention by validating details at the source.

Prevent Payment Failures Before They Happen

Failed or fraudulent payments hurt your brand and cost you money. VoPay Verify™ eliminates friction and uncertainty by validating details upfront, so you can move money with confidence.

Prevent Payment Failures Before They Happen

Failed or fraudulent payments hurt your brand and cost you money. VoPay Verify™ eliminates friction and uncertainty by validating details upfront, so you can move money with confidence.

Bank Account Verification

Mitigate Fraud Risk with Instant and Reliable Bank Account Validation

Reduce the risk of fraudulent bank transfers by instantly verifying account ownership through real-time name and address matching. For accounts without online banking, micro-deposit verification provides a secure manual confirmation step, ensuring every payout goes to a legitimate recipient.

Interac e-Transfer® Verification

Prevent Fraud and Failed Payments by Validating Recipient Emails

Basic verification checks if the email is registered and confirms the recipient's name.

Enhanced verification provides full recipient details including auto-deposit status, transaction limits, and customer type. This helps you detect risks and prevent fraud before funds leave your platform.

Interac e-Transfer® Verification

Prevent Fraud and Failed Payments by Validating Recipient Emails

Basic verification checks if the email is registered and confirms the recipient's name.

Enhanced verification provides full recipient details including auto-deposit status, transaction limits, and customer type. This helps you detect risks and prevent fraud before funds leave your platform.

Card Verification Solutions

Detect Fraud Early with Deep Identity and Billing Verification

Basic verification confirms the cardholder’s name and billing address match the records.

Enhanced verification provides full cardholder details, including card type, product category, eligibility for transfers, and risk indicators. This helps you detect fraud and assess card legitimacy before processing payments.

Platform-Ready for Every Industry

VoPay Verify™ was built for software platforms and embedded finance providers.

Gig Economy

Verify freelancer or driver payment details before disbursing funds. Reduce payout failures and accelerate onboarding.

Lending

Verify borrower identity and bank details before funding. Reduce fraud risk and accelerate time to loan disbursement.

Property

Verify tenant or landlord accounts before rent collection or disbursement. Reduce errors and simplify recurring payment setups.

Payroll

Confirm employee or contractor bank accounts with ease. Avoid payment delays and ensure accurate payroll processing.

Investment

Authenticate user accounts for funding, withdrawals, or linking external banks. Meet regulatory requirements and build investor trust.

Manage Account Verifications in the VoPay Portal

Control your entire verification experience from one place.

- Enable verification types (bank, Interac, card)

- Configure Basic vs Enhanced tiers

- Monitor status and completion rates

- Adjust billing preferences

No engineering required. Just log in and start verifying.

API-First Developer Tools & Recipes

VoPay Verify™ is built for flexibility, whether you’re using our Portal, embedding an iFrame, or calling APIs directly.

Webhooks, sandbox environments, and full documentation help your team deploy with confidence.

- cURL

- JavaScript

- PHP

- Python

API-First Developer Tools & Recipes

VoPay Verify™ is built for flexibility, whether you’re using our Portal, embedding an iFrame, or calling APIs directly.

Webhooks, sandbox environments, and full documentation help your team deploy with confidence.

Frequently Asked Questions

Talk to a Fintech Advisor Today!

1. Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

2. Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

3. Sign & onboard

Our compliance and onboarding team will guide you through the process.

4. Go live!

Choose a production date and launch your integration with confidence!

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.