Payments

Financial Tools

Process Automation

Risk & Compliance

-

Payment Methods

-

Bank Account Connectors

-

Payment Automation

-

Risk Management

-

Cross-Border Payments

-

Accounting Integrations

-

AR/AP Automation

COMING SOON -

KYC/AML

COMING SOON -

Payment Links

-

Virtual Accounts

-

Approval Workflows

-

Onboarding

-

Open Data Payments

COMING SOON -

Ledger Management

-

Payment Verification

-

Transaction Monitoring

COMING SOON

Organizations

-

Blog

-

About VoPay

-

Case Studies

-

Careers

-

Newsroom

-

Contact Us

-

Knowledge Hub

NEW -

FAQ

Learn

Company

- Products

Process Automation

-

Payment Automation

-

AR/AP Automation

COMING SOON -

Approval Workflows

-

Payment Verification

- Solutions

- Developers

- Partners

- Resources

Launch Embedded Global Cross-Border Payments on your Platform

VoPay enables financial institutions and software platforms to deliver B2B, B2P, P2B and P2P global payment experiences—white-labeled and API-ready. Send money to cards, bank accounts, digital wallets, and even cash pickup points.

Trusted By Industry Leaders

Why VoPay for Embedded Cross-Border Payments?

Faster. Smarter. Scalable.

Launch fully branded global payment services inside your platform.

Turnkey Global

Payments

Turnkey Global Payments

Support for B2B, B2P, P2B and P2P use cases with embedded UI components and developer-first APIs.

Low-Code /

No-Code Integration

Low-Code / No-Code Integration

Embed our API into your existing workflow or access via our online portal for no-code option.

White-Label

Interfaces

White-Label Interfaces

Hit a single endpoint on our API to create stunning white-label cross border payment experiences.

Real-time Currency

Monitoring

Real-time Currency Monitoring

Competitive exchange rates with intelligent routing & track rates for up to 10 currencies.

Multiple Delivery

Methods

Multiple Delivery Methods

Multi-channel including direct bank transfers, mobile wallets, push-to-card payments and cash pickups.

Choose the Right Model for Your Business

| As-a-Service | Managed Service | |

|---|---|---|

| Ideal For | Platforms with internal compliance teams | Teams seeking a turnkey solution |

| Control Level | Partial (VoPay handles select components) | Full (VoPay handles everything A-Z) |

| Launch Speed | Moderate | Fastest path to market |

| You Handle | Underwriting, reporting | Nothing — fully outsourced |

Send Funds In Real-Time To Multiple End Points Around The World

Our cross-border solution allows businesses to facilitate global transactions to multiple delivery channels.

Send funds to bank accounts, mobile wallets, cards, and even cash pick-up locations—all managed through a single interface or API.

Send Funds In Real-Time To Multiple End Points Around The World

Our cross-border solution allows businesses to facilitate global transactions to multiple delivery channels.

Send funds to bank accounts, mobile wallets, cards, and even cash pick-up locations—all managed through a single interface or API.

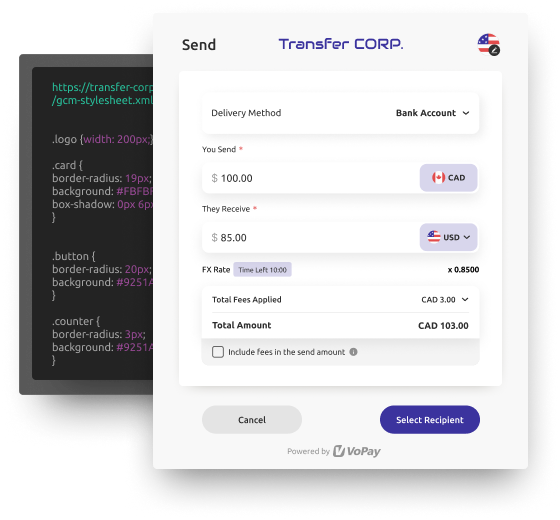

Monetize Transactions With Our White-Label Cross-Border Experience

We’ve built an entire cross border transaction experience that can be deployed using a single endpoint and embedded into your existing platforms.

White-label the entire workflow using your own stylesheet, and offer cross border payments to your customers as a fully branded experience.

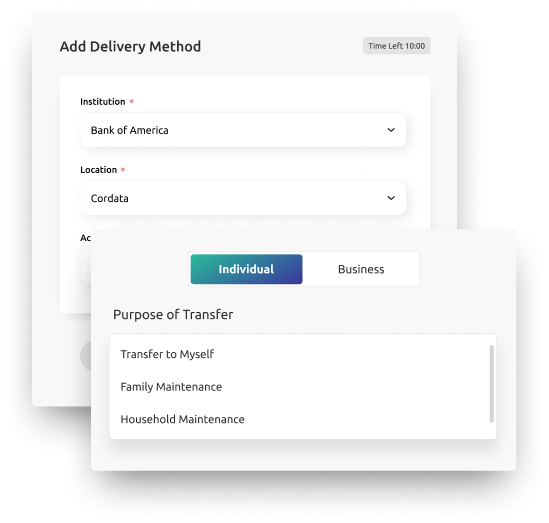

Personal & Business Cross-Border Transactions In one Workflow

Our cross-border services allow you to offer business and individual transactions to your customers while adhering to the appropriate regulator requirements.

Streamline global payments with a single, efficient workflow, designed to enhance user experience and build trust with seamless compliance.

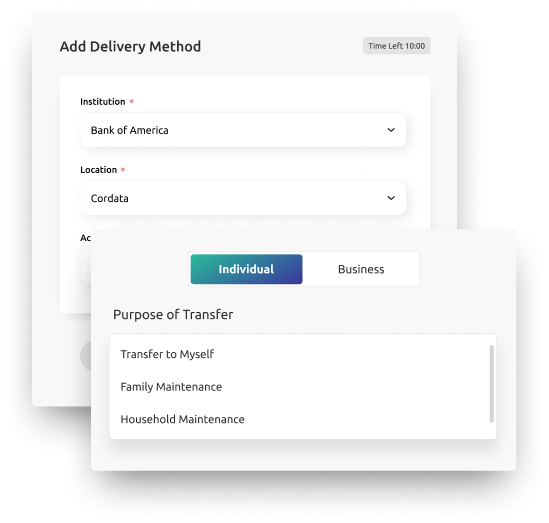

Personal & Business Cross-Border Transactions In one Workflow

Our cross-border services allow you to offer business and individual transactions to your customers while adhering to the appropriate regulator requirements.

Streamline global payments with a single, efficient workflow, designed to enhance user experience and build trust with seamless compliance.

Built for Every Use Case

Scale confidently with embedded global payments designed to match your business model.

B2B Cross-Border Payments

Support multi-currency business payments with full transparency and control. VoPay enables platforms to send funds to suppliers, partners, and vendors in 140+ currencies—with automated reconciliation, payment routing, and compliance built in.

Power vendor payouts, invoice settlements, and corporate disbursements.

B2P Payments

From cross-border payroll to insurance claims or tuition reimbursements, VoPay’s B2P capabilities help you deliver fast, secure payments with full auditability and flexible methods including push-to-card, bank transfers, and mobile wallets.

Simplify global disbursements to individuals—contractors, customers, or employees.

P2P Transfers

Enable end users to transfer funds across borders with full KYC/AML compliance, real-time transaction tracking, and intuitive UI components. Ideal for fintechs building consumer-facing experiences where speed and trust are paramount.

Embed peer-to-peer functionality into wallets, remittance apps, or community platforms.

Access Our Comprehensive APIs To Build Your Own Cross-Border Workflows

Build and deploy your own custom experiences using our extensive global cash management endpoints on our single-layer API.

Test our Mastercard functions in the sandbox and launch with confidence with the help of our dedicated integration support team.

- cURL

- JavaScript

- PHP

- Python

Access Our Comprehensive APIs To Build Your Own Cross-Border Workflows

Build and deploy your own custom experiences using our extensive global cash management endpoints on our single-layer API.

Test our Mastercard functions in the sandbox and launch with confidence with the help of our dedicated integration support team.

Access Global Payouts From Our Dedicated Online Portal

Set up global money transfers to partners and customers directly from our user-friendly Portal, and deploy the same white-label experiences in a no-code format.

Get real-time transaction data, account balances, and contact information to understand user behavior and business opportunities.

Frequently Asked Questions

Talk to a Fintech Advisor Today!

1. Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

2. Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

3. Sign & onboard

Our compliance and onboarding team will guide you through the process.

4. Go live!

Choose a production date and launch your integration with confidence!

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.