Payment Features

Developer Zone

Partners

Learn

Company

- Products

-

EFT Payments

Innovative Bank Account Payments

-

Interac e-Transfer For Business

Send and Request Real-Time Transfers

-

Push To Card

Send Funds To Cardholder Accounts Instantly

-

VoPay Instant

Real-Time EFT Payment Technology

-

ACH Payments

US Bank Account Payment Technology

Payment Features

-

iQ11: Intelligent EFT

Faster, Data-Driven EFT Payments

-

Instant Bank Account Verification new

Micro-Deposit Verification with VoPay Verify

-

VoPay 360

Automate Accounting Operations with a 360 view

-

Ledger Management new

Control Flow Of Funds With Multiple Ledgers

-

Pre-Authorized Debit

Digital PAD For Today’s Consumer

- Use Cases

- Developers

- Pricing

- Partners

- Resources

Payment Features

Developer Zone

Partners

Learn

Company

- Products

- Use Cases

- Developers

- Pricing

- Partners

- Resources

Smarter Bank Account Payment Technology

We’ve partnered with Plaid to combine open banking technology with our payment API to give an unmatched bank account payment experience.

Open Banking Data Meets Payment processing

Plaid’s open banking API perfectly complements VoPay’s payment API to create intelligent bank account payments.

Bank Account Verification

Validate customer account details and verify available funds at the time of transaction.

Reduce NSFs

Cut down your NSF fees to near zero by having access to account performance and balance prior to collecting funds.

Faster Payments

Speed up transaction times to up to 1 business day by validating the transaction status.

Account Tokenization

Tokenize customer details and use them for future transactions without having to request banking information again.

How Do Payments Work With Plaid?1

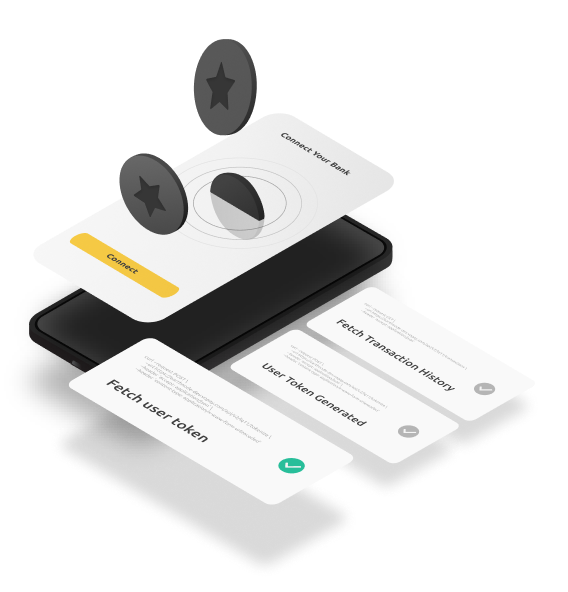

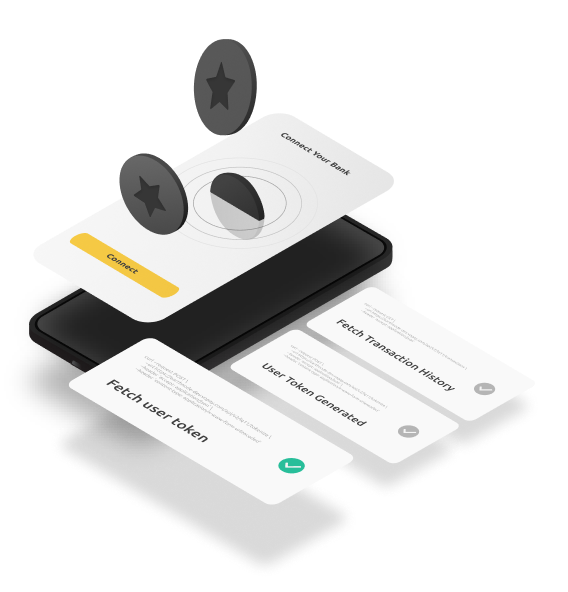

Sync Your Plaid Account With VoPay

Connect your Plaid account to VoPay using the account/set-plaid-credentials endpoint to setup the integration.

2

Use Plaid Link To Receive Bank Details

Customers use Link to connect their bank account for EFT/ACH transactions, which returns a Plaid Public Token & Account ID.

3

Exchange For Processor Token

Once the Public Token is generated, you can then call Plaid’s API to request a Processor Token.

4

Use Plaid Tokens For Payments

You can then use new and existing Processor Tokens to call VoPay API endpoints for EFT/ACH payments.

1

Sync Your Plaid Account With VoPay

Connect your Plaid account to VoPay using the account/set-plaid-credentials endpoint to setup the integration.

2

Use Plaid Link To Receive Bank Details

Customers use Link to connect their bank account for EFT/ACH transactions, which returns a Plaid Public Token & Account ID.

3

Exchange For Processor Token

Once the Public Token is generated, you can then call Plaid’s API to request a Processor Token.

4

Use Plaid Tokens For Payments

You can then use new and existing Processor Tokens to call VoPay API endpoints for EFT/ACH payments.

1

Sync Your Plaid Account With VoPay

Connect your Plaid account to VoPay using the account/set-plaid-credentials endpoint to setup the integration.

2

Use Plaid Link To Receive Bank Details

Customers use Link to connect their bank account for EFT/ACH transactions, which returns a Plaid Public Token & Account ID.

3

Exchange For Processor Token

Once the Public Token is generated, you can then call Plaid’s API to request a Processor Token.

4

Use Plaid Tokens For Payments

You can then use new and existing Processor Tokens to call VoPay API endpoints for EFT/ACH payments.

1

Sync Your Plaid Account With VoPay

Connect your Plaid account to VoPay using the account/set-plaid-credentials endpoint to setup the integration.

2

Use Plaid Link To Receive Bank Details

Customers use Link to connect their bank account for EFT/ACH transactions, which returns a Plaid Public Token & Account ID.

3

Exchange For Processor Token

Once the Public Token is generated, you can then call Plaid’s API to request a Processor Token.

4

Use Plaid Tokens For Payments

You can then use new and existing Processor Tokens to call VoPay API endpoints for EFT/ACH payments.

The Future Of Bank Account Payments

VoPay’s integrated suite of payment rails can be combined with Plaid’s open banking technology to create better payment experiences for the end user.

Let customers complete a one-time bank account connection flow and then tokenize their data to be reused for future transactions.

Safer Transactions With Tokenization

Use your existing Plaid data tokens or let users connect their bank account using iQ11 and VoPay will generate a unique token for that customer.

Tokens can be safely stored and then used for future verification or transactions without the need to ask users for banking details.

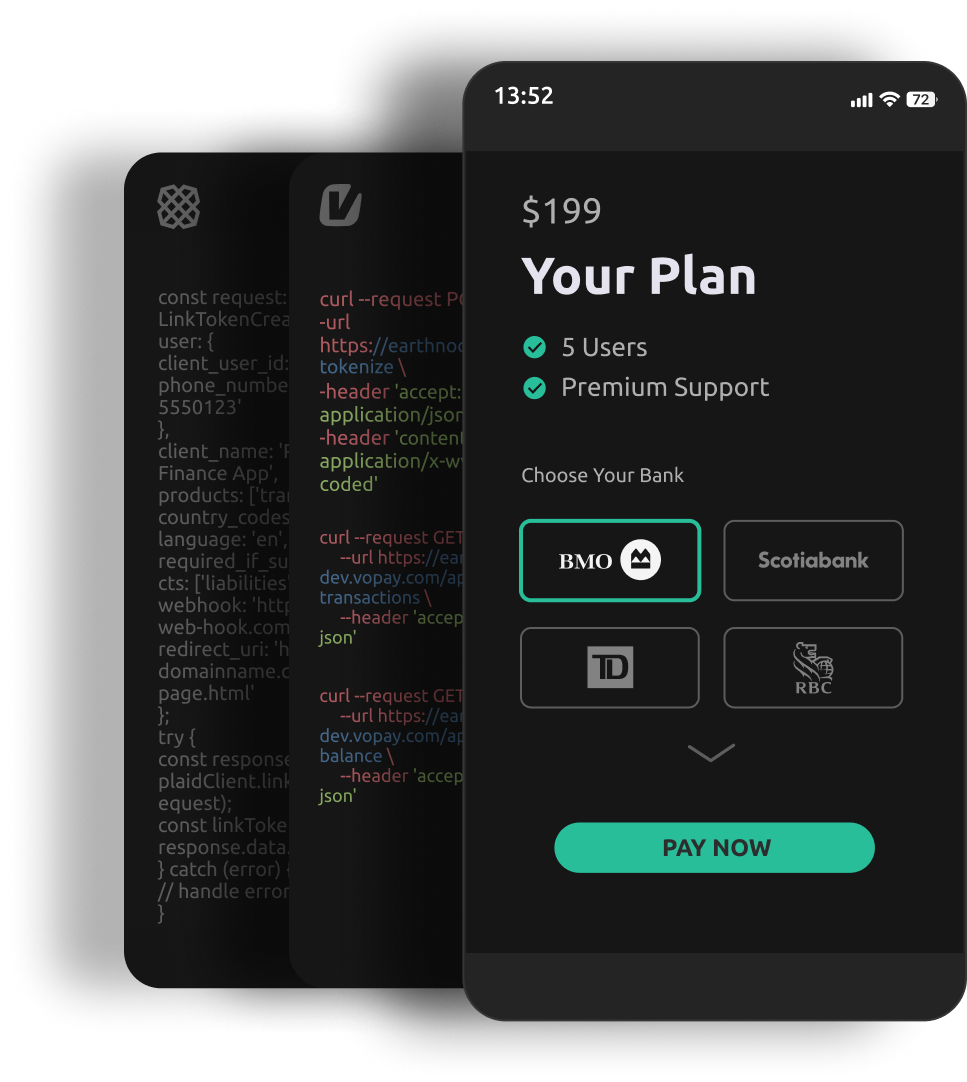

Use Your Existing Plaid Tokens With Our API

Leverage your existing data tokens from your Plaid integration so users can skip the bank connection steps and complete checkout instantly.

Get frictionless payments on you platform by syncing your Plaid account with your VoPay account in just a few steps.

- cURL

- JavaScript

- PHP

- Python

Smarter Payments For Any Industry

Companies across multiple industries have integrated with the VoPay API using our recipes and developer docs.

Faster earned wage access for workers to keep them loyal to your platform.

Low-cost deposits and collections to streamline your lending payments.

Handle large payments with ease and speed up cash-flow with faster payments.

Move money between bank accounts with speed, efficiency and control.

Better recurring billing and reduced transaction fees for digital platforms.

Accelerate Cashflow With Faster Bank Payments

Improved cash flow and customer satisfaction with significantly improved processing times:

Standard EFT : T+3 Business Days Processing

Send/Collect EFT Payment

(2-3 days)

1

Day 1

Transfer initiated

2

Day 2

Transaction in Progress

3

Day 3

Funds available

VoPay + Plaid : T+1 Business Day Processing

Send/Collect EFT Payment

(1 day)

1

Day 1

Transfer initiated

1

Day 1

Funds available

Connect Your Plaid Account With VoPay

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.

Functional Always active

Preferences

Statistics

Marketing

VoBot

VoBot

I’m VoPay’s AI assistant,

how can I help?

Click here to return to VoBot.