Rails

Use Case

Integration Time

Intro

Goparity is transforming the Canadian financial landscape by connecting investors with socially and environmentally beneficial projects. As the first platform of its kind in Canada, inspired by its successful European counterpart, Goparity not only facilitates investments but also serves as a community hub aimed at making sustainable investing accessible to all Canadians. Successfully launching this platform required overcoming significant compliance and payment processing challenges, necessitating a partnership with a capable payment provider.

"We truly believe in a future where everyone has access to making tangible investments and working with key partners to do that is how we'll make this successful."

Elliot Warner, Director of Technology, Goparity CanadaThe Problem

Goparity is entering a challenging Canadian market where impact investing is still emerging. While promoting a relatively new investment model, the company had to navigate complex financial regulations and manage intricate banking and payment processes. Goparity's crowd-lending business model requires a balance between volume and efficiency. Effective operations and technology are critical, allowing a broad user base to invest with minimal resource expenditure. This setup is vital to support diverse investment preferences without maintaining robust accounting standards.

Core Challenges Identified

1. Building Payment Infrastructure

Initially, Goparity considered developing an in-house payment system but faced prohibitive costs, substantial resource demands, and regulatory complexities. These challenges would have delayed the launch and increased operational expenses, prompting the shift to partner with a recognized payment provider.

2. Payment Processing Complexities

Despite many available processors, few could meet the specific demands of an impact investment platform. The critical need for e-wallet integration to facilitate smooth transactions became apparent as GoParity struggled with processors that could not support essential features, leading to increased overhead and complex user interactions.

3. Regulatory Compliance Hurdles

As a newcomer, Goparity found adhering to the Ontario Security Commission's worked with the OSC to accelerate their launch and ensure compliance to some of the world's strictest standards. These regulations presented significant obstacles in aligning their business operations with legal standards.

4. Fostering Platform Trust

Establishing trust is crucial in an online-only environment, particularly in a market new to impact investing. The absence of physical interactions necessitated a partnership with a reputable and leading brand to enhance credibility and strengthen investor confidence.

5. Operational Challenges in Transaction Management

Existing payment solutions failed to efficiently handle small investments, leading to prolonged settlement times and a poor user experience. This inefficiency resulted in lower user retention and challenges in attracting new investors.

The Solution

"The primary feature that drew us to VoPay was the e-wallet capability. We recognized early on that for our platform to operate efficiently, it was essential for users to have e-wallets. This functionality allows users to deposit funds easily, enabling a seamless flow of transactions between borrowers and lenders. By minimizing transaction frequency and overhead, everything can be managed directly on the platform, allowing funds to be reinvested and their impact and returns to compound effectively."

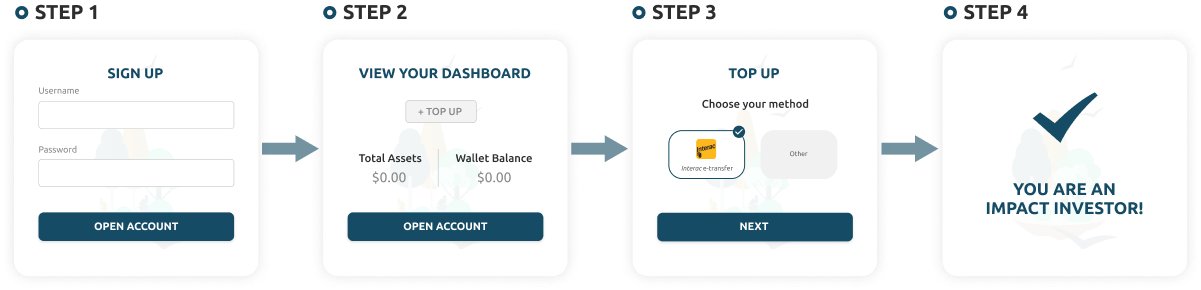

Elliot Warner, Director of Technology, Goparity CanadaHow It Works

The Results

"VoPay's credentials and experience in secure payment processing significantly enhance user trust in our platform. This transparency is vital in the new and growing field of impact investing, where our commitment to openness and education is fundamental to our success."

Blake Bunting, Founder & Director of Business Development, GoparitySee How Fintech-as-a-Service Can Work For You

Get The Latest News In Fintech

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.