Payment Features

Developer Zone

Partners

Learn

Company

- Products

-

EFT Payments

Innovative Bank Account Payments

-

Interac e-Transfer For Business

Send and Request Real-Time Transfers

-

Push To Card

Send Funds To Cardholder Accounts Instantly

-

VoPay Instant

Real-Time EFT Payment Technology

-

ACH Payments

US Bank Account Payment Technology

Payment Features

-

iQ11: Intelligent EFT

Faster, Data-Driven EFT Payments

-

Instant Bank Account Verification new

Micro-Deposit Verification with VoPay Verify

-

VoPay 360

Automate Accounting Operations with a 360 view

-

Ledger Management new

Control Flow Of Funds With Multiple Ledgers

-

Pre-Authorized Debit

Digital PAD For Today’s Consumer

- Use Cases

- Developers

- Pricing

- Partners

- Resources

Payment Features

Developer Zone

Partners

Learn

Company

- Products

- Use Cases

- Developers

- Pricing

- Partners

- Resources

The Payment Powerhouse built For Lending Platforms

Collect and send payments across multiple payments rails, utilize unlimited virtual accounts, and scale quickly with automated workflows.

Become informed about your borrowers by verifying their bank balance to reduce NSFs, lower costs and increase user satisfaction on your lending platform.

Fund Faster On Your Lending Platform

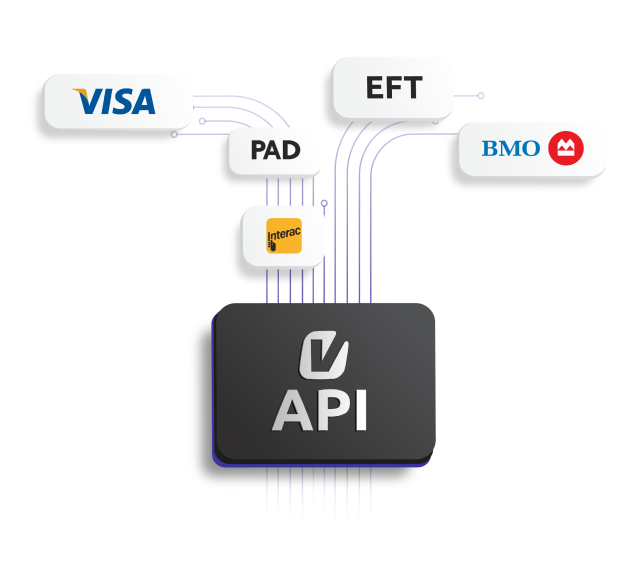

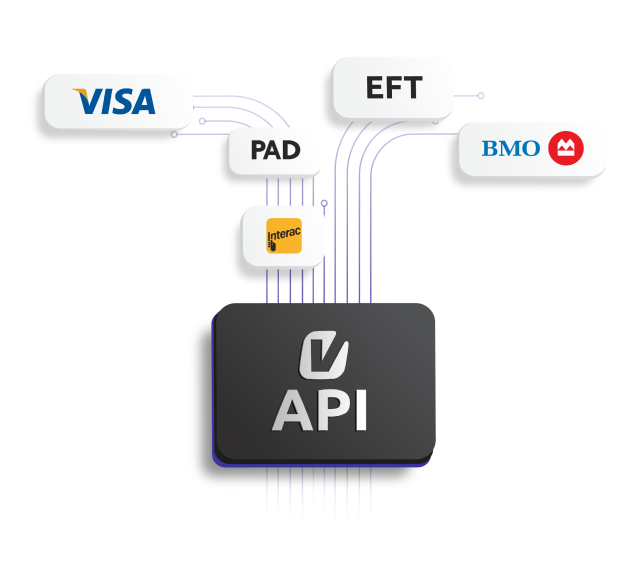

Our single-layer payment API is designed to give lending platforms the tools they need to build, perfect and scale their lending operations.

Accept Partial Payments

Give borrowers the flexibility to pay loans partially or in full for a better lending experience.

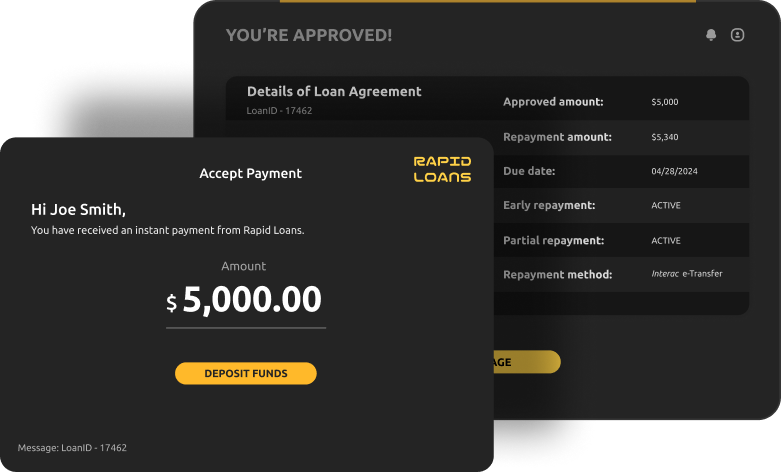

Fund In Real-Time

Send loans to borrowers instantly to meet market expectations and increase customer satisfaction.

Scheduled Collections

Automate repayments with scheduled collections that can be triggered once or on a recurring basis.

Bank Account Verification

Reduce failed payments and NSFs using iQ11 to connect customer bank accounts and validate their balance.

Setup Unlimited Virtual Account Structures To Optimize The Flow Of Funds

Move and hold funds using dedicated accounts in a customized hierarchy unique to your business.

Unlimited virtual account structures for every lending use-case.

Example: A lending platform creates a virtual account for each borrower and allows them to pay off their balance in installments.

Manage Cash Flow with Multiple Payment Rails to Push & Pull Funds

Reduce defaults and missed payments by giving borrowers more ways to pay with instant Request Money, recurring EFT payments and partial repayment options.

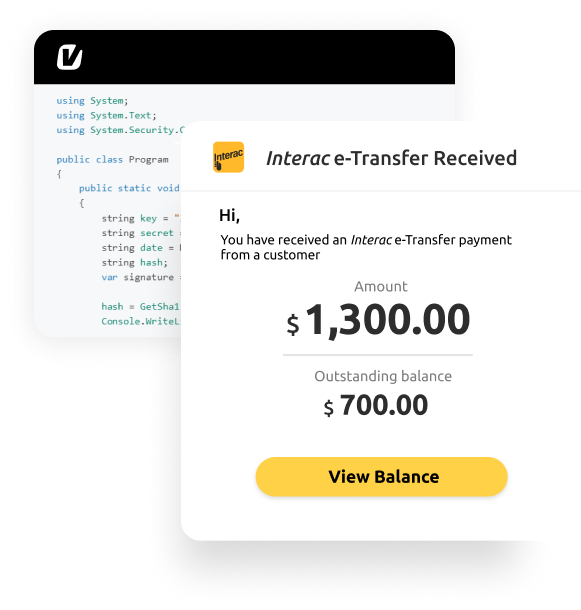

Interac e-Transfer allows lenders to fund loans in real-time and request repayments from customers using a payment service they like and trust.

Payments, Risk & Automation On A single Lending API

Outsource risk and fraud mitigation activities and focus on growing customer acquisition on your loan management platform.

Our fintech technology bundles payments, automation and risk intelligence tools into one dedicated toolkit designed to integrate with any lending platform in less than 3 weeks.

Use Tokenization for Scheduled Recurring Collections

Utilize recurring workflows on your platform so when a loan is approved, a collection schedule is automatically setup from a single endpoint on our API.

Let customers connect their bank account to your platform and tokenize banking credentials through our iQ11 solution for frictionless lending payments on your platform.

Made For Developers, By Developers

Do everything from a single-API layer on a platform designed to give developers the tools they need to create the perfect workflows and experiences.

Integrate multiple payment rails rapidly using our extensive API docs and use our dedicated lending recipe to accelerate development time.

- cURL

- JavaScript

- PHP

- Python

Made For Developers, By Developers

Do everything from a single-API layer on a platform designed to give developers the tools they need to create the perfect workflows and experiences.

Integrate multiple payment rails rapidly using our extensive API docs and use our dedicated lending recipe to accelerate development time.

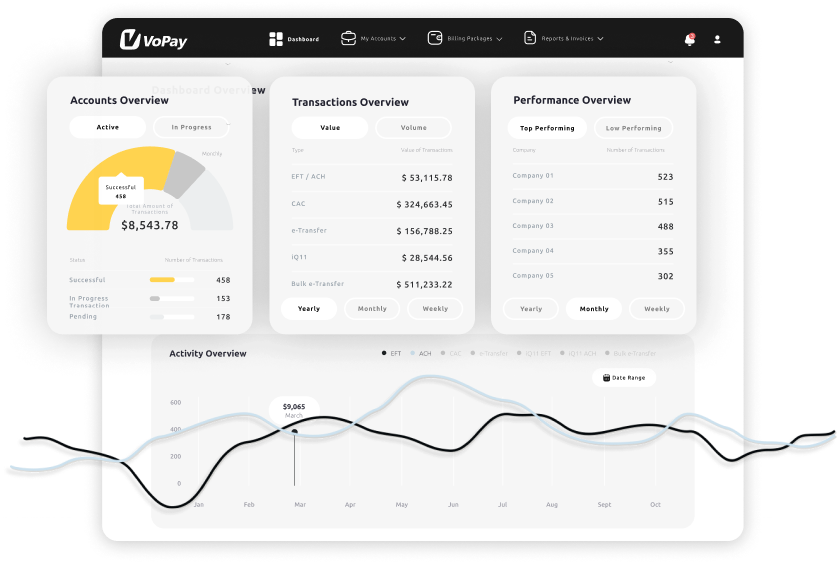

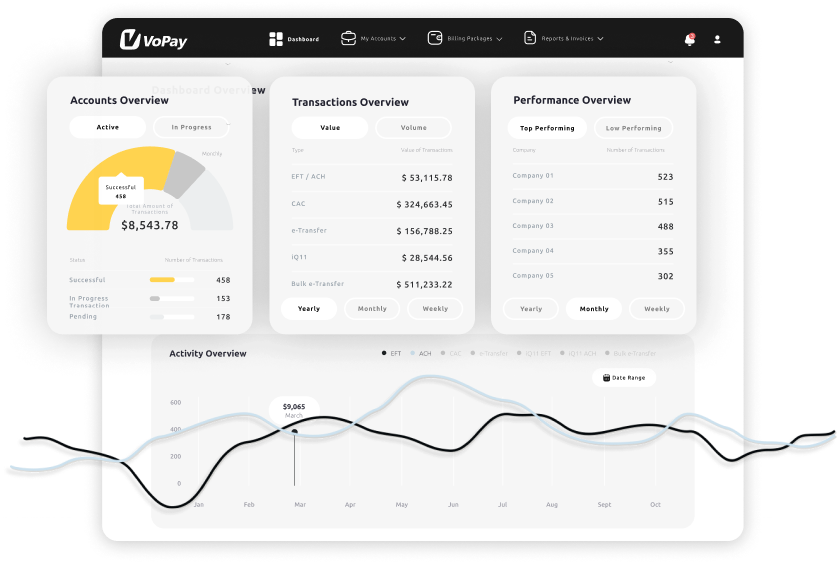

One Place To Manage Lending Transactions

Collect, send & monitor payments from VoPay's user-friendly Portal designed to empower your business with rich transaction data & analytics.

Create new user accounts and set granular permissions based on business requirements so you are always in control.

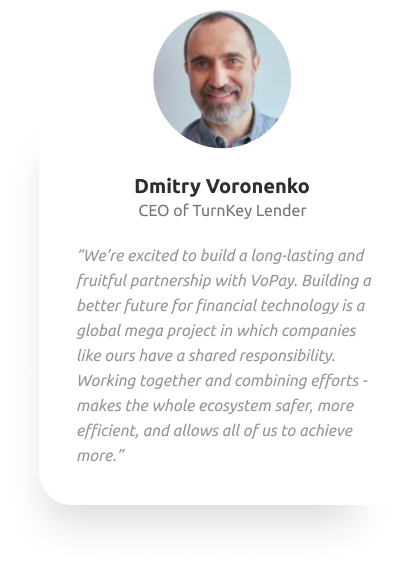

Proudly Supported By Industry Leaders Across North America

Speak to a Fintech Advisor Today!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Onboarding Support

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.

Functional Always active

Preferences

Statistics

Marketing

VoBot

VoBot

I’m VoPay’s AI assistant,

how can I help?

Click here to return to VoBot.