Payment Features

Developer Zone

Partners

Learn

Company

- Products

-

EFT Payments

Innovative Bank Account Payments

-

Interac e-Transfer For Business

Send and Request Real-Time Transfers

-

Push To Card

Send Funds To Cardholder Accounts Instantly

-

VoPay Instant

Real-Time EFT Payment Technology

-

ACH Payments

US Bank Account Payment Technology

Payment Features

-

iQ11: Intelligent EFT

Faster, Data-Driven EFT Payments

-

Instant Bank Account Verification new

Micro-Deposit Verification with VoPay Verify

-

VoPay 360

Automate Accounting Operations with a 360 view

-

Ledger Management new

Control Flow Of Funds With Multiple Ledgers

-

Pre-Authorized Debit

Digital PAD For Today’s Consumer

- Use Cases

- Developers

- Pricing

- Partners

- Resources

Payment Features

Developer Zone

Partners

Learn

Company

- Products

- Use Cases

- Developers

- Pricing

- Partners

- Resources

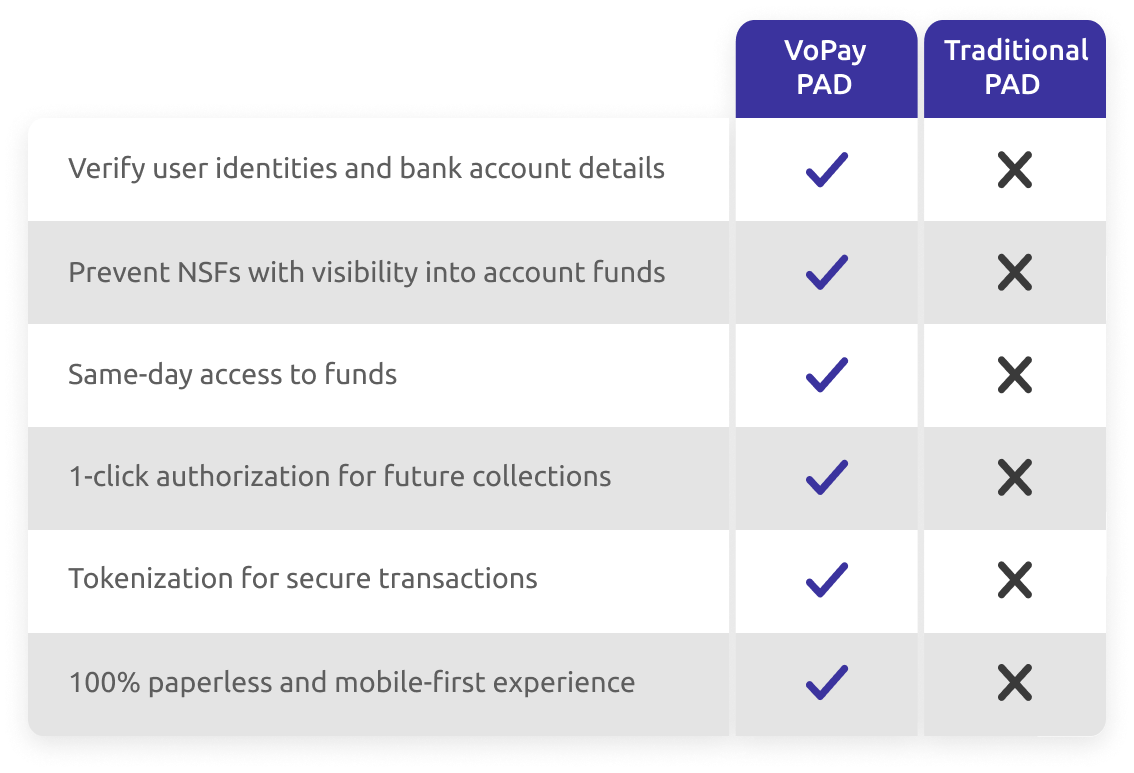

Pre-Authorized Debit Built For Today’s Digital Economy

VoPay’s electronic PAD payments make everything easier for your customers, from authorization right through to payment collection.

Give your users complete peace of mind with advanced security measures and the ultimate convenience with embedded PAD agreements that take seconds to complete.

Commercial PAD Payment Processing with End-to-End Automation

VoPay’s payment API lets you setup and customize how you handle pre-authorized payments for your business. Text, email or embed a simple payment link into your existing payment flow to start collecting digital PAD today.

Faster PAD Payments

Send digital PAD agreements in seconds and get faster payouts with VoPay’s EFT payment rail optimized for business.

Dedicated Industry SDKs

Our payment API comes with industy-specific SDKs to ensure a smooth and streamlined integration process.

Simplify Future Transactions

Let customers connect their bank accounts to streamline future PAD transactions and reduce errors.

Verify Account Details

Verify customer account details and bank balances to minimize errors, verify funds and reduce the likelihood of NSFs.

How Do PAD Payments Work With VoPay?1

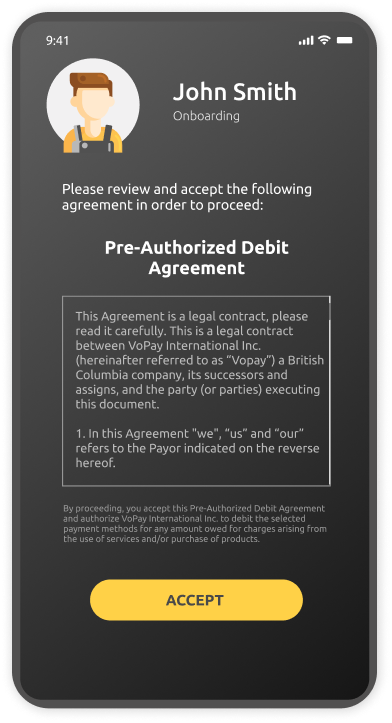

Customer Authorizes PAD Agreement

The customer authorizes the PAD agreement on the merchants platform or via a payment link.

2

Secure Bank Account Connection

The customer connects their bank account by entering their online banking information.

3

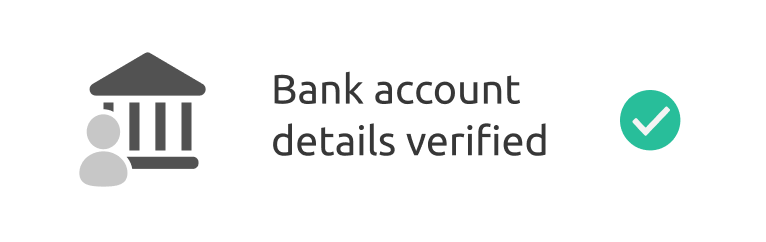

Bank Account Verification

VoPay then validates the bank account details and verifies the available funds within the customer account (iQ11 only).

4

PAD Agreement Finalized

VoPay tokenizes the data before passing it to the merchant allowing single or recurring collections.

1

Customer Authorizes PAD Agreement

The customer authorizes the PAD agreement on the merchants platform or via a payment link.

2

Secure Bank Account Connection

The customer connects their bank account by entering their online banking information.

3

Bank Account Verification

VoPay then validates the bank account details and verifies the available funds within the customer account (iQ11 only).

4

PAD Agreement Finalized

VoPay tokenizes the data before passing it to the merchant allowing single or recurring collections.

1

Customer Authorizes PAD Agreement

The customer authorizes the PAD agreement on the merchants platform or via a payment link.

2

Secure Bank Account Connection

The customer connects their bank account by entering their online banking information.

3

Bank Account Verification

VoPay then validates the bank account details and verifies the available funds within the customer account (iQ11 only).

4

PAD Agreement Finalized

VoPay tokenizes the data before passing it to the merchant allowing single or recurring collections.

1

Customer Authorizes PAD Agreement

The customer authorizes the PAD agreement on the merchants platform or via a payment link.

2

Secure Bank Account Connection

The customer connects their bank account by entering their online banking information.

3

Bank Account Verification

VoPay then validates the bank account details and verifies the available funds within the customer account (iQ11 only).

4

PAD Agreement Finalized

VoPay tokenizes the data before passing it to the merchant allowing single or recurring collections.

Setup Easy Recurring Billing With Digital PAD Agreements

Remove the friction from your PAD signup process and make the PAD agreement a joy for your customers to use.

In just a few taps your customers can securely login to their online banking service and authorize single or recurring PAD payments in seconds.

Prevent NSFs On Recurring Payments With iQ11

VoPay proprietary iQ11 open banking technology gives businesses full visibility into customer accounts and available funds.

This means you can reduce the rate of Non-Sufficient Fund returns to near zero, drastically reducing the amount of time and money you spend on collecting payments.

Faster Direct Debits With VoPay’s Digital PAD Payments

Move your recurring payments forward with digital PAD transactions that remove friction and increase customer retention rates.

Automate every aspect of your customer billing cycle using one platform that comes with infinite flexibility across multiple payment rails.

Industry Use-Cases

Our integration recipes are designed to give you tools to build out custom payment setups unique to your industry.

Streamline platform billing and speed up collections with electronic PADs.

Low-cost deposits and simplified PAD collections for lenders.

Handle large payments at scale and automate billing via digital PAD.

Setup recurring A2A payments to move money between bank accounts.

Better recurring billing and reduced fees for subscription platforms.

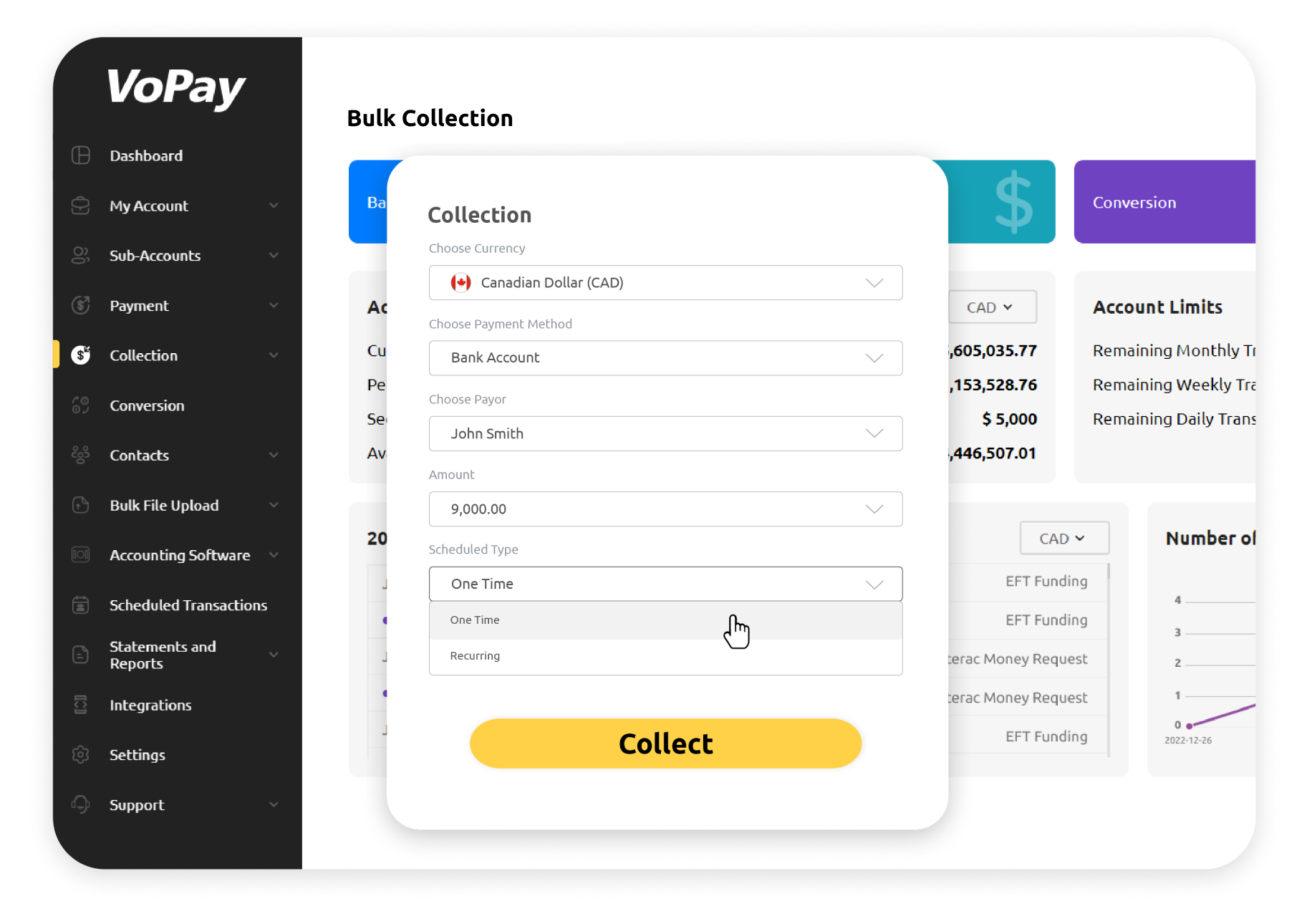

Manage PAD Payments From The VoPay Portal

Our payment portal has been designed to be used alongside our API, or as a dedicated standalone tool for managing your business payments.

Manage your PAD transactions, view your outstanding payments and access account balances all from a single dashboard complete with financial data and analytics.

Pre-Authorized Debit API For An Embedded Payment Experience

Our payment API comes fully loaded with over 250 endpoints that give access to payment rails, open banking, risk intelligence and more.

Setup, edit and manage your pre-authorized debits using our single-layer API integration for full control of direct debit payment collections.

- cURL

- JavaScript

- PHP

- Python

Pre-Authorized Debit API For An Embedded Payment Experience

Our payment API comes fully loaded with over 250 endpoints that give access to payment rails, open banking, risk intelligence and more.

Setup, edit and manage your pre-authorized debits using our single-layer API integration for full control of direct debit payment collections.

Free eBook

Transforming Pre-Authorized Debit: Capitalizing On Bank Account Payment Innovation

On their time. In their way. Today’s consumers expect diverse digital payment options. Today’s payment journey needs to be contactless, seamless and secure. As society moves away from paying one way to multiple ways, account-to-account payments lead the way.

Frequently Asked Questions

Speak to a Fintech Advisor Today!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.

Functional Always active

Preferences

Statistics

Marketing

VoBot

VoBot

I’m VoPay’s AI assistant,

how can I help?

Click here to return to VoBot.