Coming soon

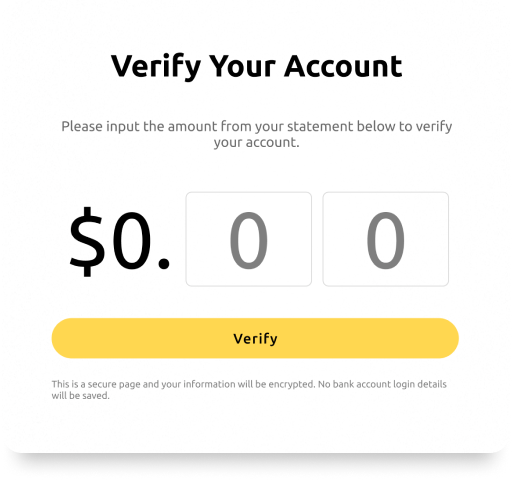

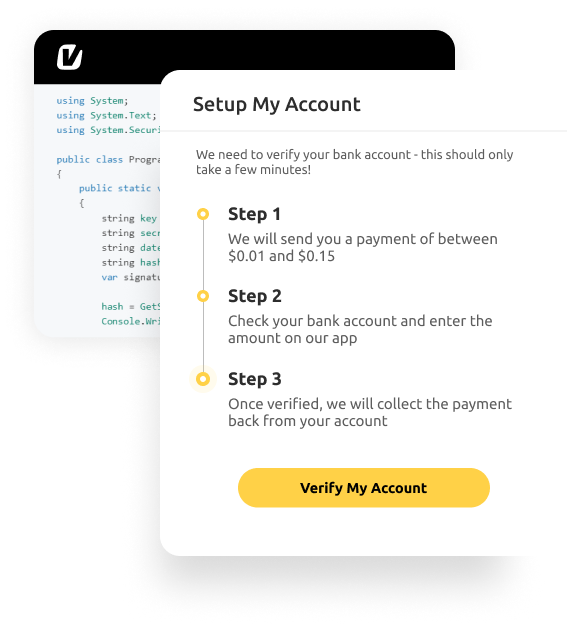

Verify Bank Accounts In Real-Time With Micro-Deposits

Instant micro-transactions allow you to authenticate customer bank accounts in real-time, reducing the risk of fraud and enhancing the payment process.

Accelerate onboarding and improve user experience on your platform, while ensuring every customer bank account is valid and functional.

Validate User Bank Accounts In Any Vertical

Our integration recipes are designed to give businesses in any industry the tools to build payments into their platform quickly and accurately.

Use micro-deposits to confirm the authenticity of users and their bank accounts.

Validate borrowers’ bank accounts prior to funding to reduce the risk of default.

Use micro-transactions to verify tenant accounts are correct and functional.

Send small deposits to unknown bank accounts to confirm ownership.

Ensure employee bank account details are correct and prevent errors.

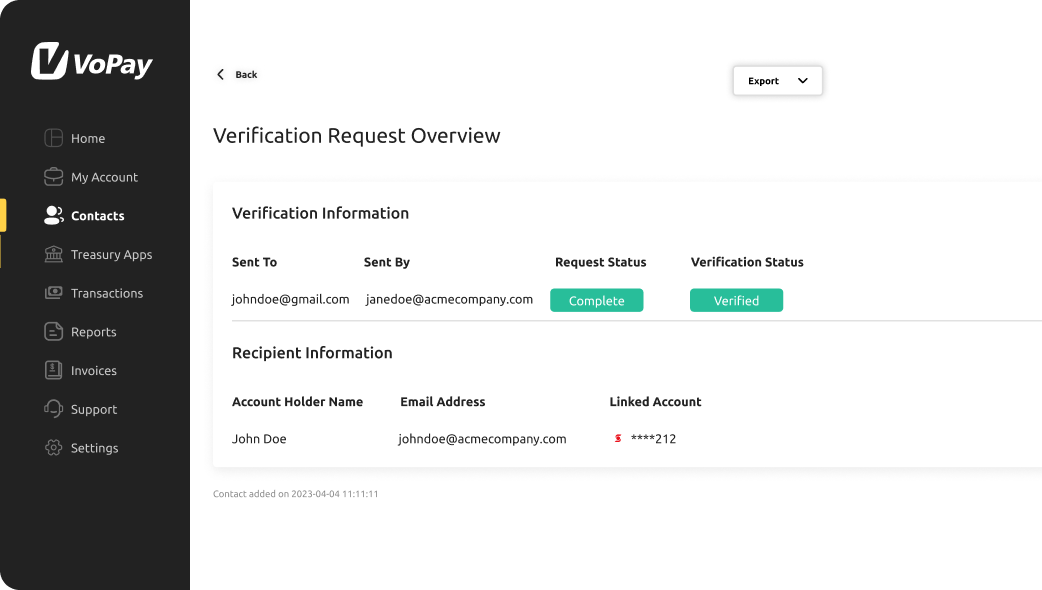

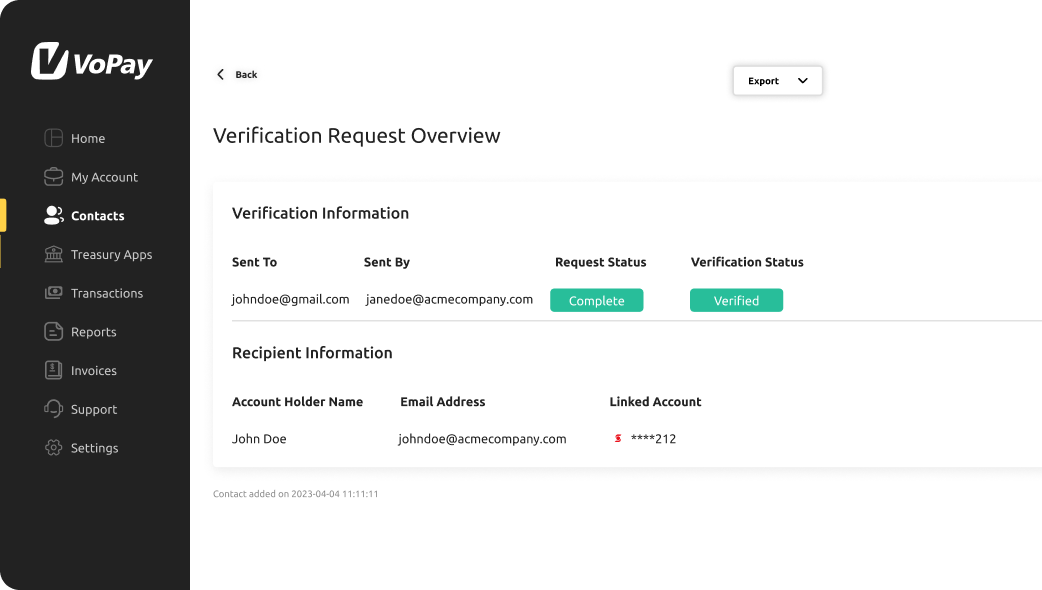

Manage Micro-Deposit Verification Using The VoPay Portal

Use the VoPay Portal to setup and manage micro-deposits for your contacts with just a few clicks.

Monitor the verification status of new accounts and utilize successful connections to start moving money with confidence.

Frequently Asked Questions

Speak to a Fintech Advisor Today!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Onboarding Support

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.

VoBot

VoBot

I’m VoPay’s AI assistant,

how can I help?

Click here to return to VoBot.