Rails

Use Case

Integration Time

Intro

Sparrow is a home-sharing platform that reimagines how Canadians use and share housing spaces. Like a long-term Airbnb with a touch of online dating, Sparrow matches renters and landlords based on compatibility and values to create safe and meaningful connections.

Dedicated to tackling housing affordability and loneliness in Canada, Sparrow connects hosts with spare rooms with those seeking a place to live. With over 12 million empty bedrooms nationwide, interest rate concerns, and inflation, the platform has begun to see exponential growth. However, it was not equipped to handle one of the most critical aspects of the experience: rent transactions.

Without a built-in payment solution integrated into its platform, Sparrow relied on tenants and hosts to manage rent payments independently using Interac e-Transfer®. While this approach was initially manageable, as the platform scaled, it became increasingly clear that this limitation could significantly impact Sparrow's ability to maximize its market and revenue potential.

The Problem

1. Lack of Payment Oversight

As Sparrow's user base grew, they needed better payment oversight. Without a payment integration solution, they couldn't ensure timely payments or manage transactions effectively. To enhance trust and prevent disputes between renters and landlords, Sparrow sought a reliable payment process to improve their platform's overall experience.

2. Administrative Burden on Users

Managing payments off-platform required users to handle reminders, track payments, and resolve issues on their own. This increased their administrative burden, making the experience less convenient and more error-prone. Renters and landlords had to coordinate and remember payment schedules manually, often leading to mistakes like forgotten or incorrect payments and miscommunication. These errors caused delays and missed payments, resulting in frustration for both parties.

3. Limitations in Product Offering

Without control over payments, Sparrow was unable to integrate additional features that would enhance the user experience and streamline operations. This limitation hindered Sparrow from offering a comprehensive service that could better meet users' needs, ultimately affecting user satisfaction and retention.

4. Hindrance to Product Development

Sparrow needed a sophisticated, autonomous payment system to focus on developing advanced platform features. They needed a tailored, flexible solution. Without it, they couldn't allocate the time and resources needed to improve their product, enhance user experiences, and drive market potential and revenue growth.

The Solution

Sparrow turned to VoPay for its advanced payment API solution to address these challenges. While Sparrow investigated other industry players, such as financial institutions and others that offered Interac e-Transfer, VoPay’s advanced payment capabilities and ledger management features stood out.

What stood out about VoPay was their technology stack; it outperformed every other option we considered. The ability to integrate e-wallets into our system was a game-changer. Each of our customers now has an online client wallet that functions like a virtual bank account on VoPay. While most providers can facilitate an Interac e-Transfer, they can't offer a client wallet where you can specify that funds should be pulled and held in a separate account until you decide to disburse them into another designated account."

Oren Singer, Co-Founder & CEO at SparrowLedger Management and Virtual Accounts

Simplified Fund Management

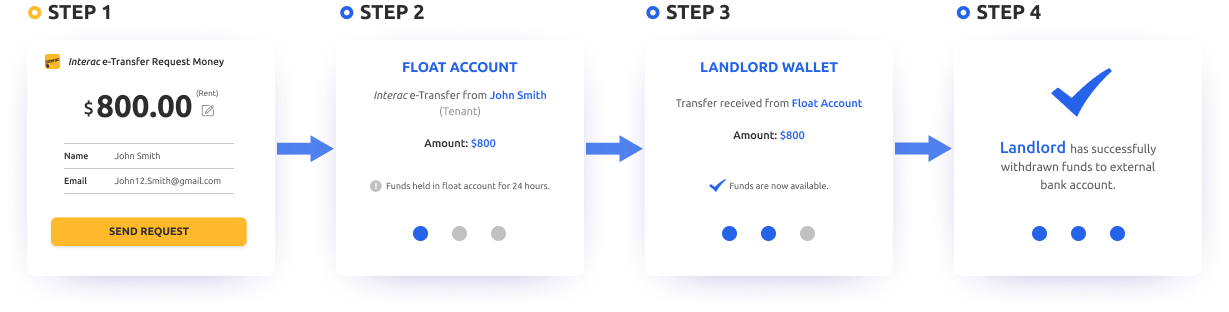

Sparrow can now handle rent payments directly on the platform. This includes collecting tenant payments, holding the funds securely, and disbursing them to landlords as needed. Sparrow can monitor transactions in real-time and have complete visibility into transaction histories. This setup allows Sparrow to split payments or forward them using different payment methods like Direct Debit.

Automated Payment Workflows

Real-Time Payment Status Updates

With VoPay’s API, Sparrow receives real-time updates on payment statuses, bringing multiple benefits:

• Improved Accuracy: Every transaction can be tracked, ensuring accurate and timely payment processing.

• Automated Systems: These updates enable Sparrow to build automated features such as rent payment reminders, missed or late payment notifications, and instant confirmations for landlords and tenants.

How It Works

The Results

"We can offer Sparrow Care because we process the rental payments with VoPay."

Gavin Servai, Co-Founder & CTO at Sparrow

"Our platform has seen remarkable growth in recent months. By embedding VoPay's payment API into our solution, we have significantly enhanced the home-sharing experience, making it safer and easier for our members to share their spaces comfortably and reliably."

Oren Singer, Co-Founder & CEO at Sparrow"VoPay makes it easier to manage funds and provides incredible flexibility. We've built our own highly configurable payment processing system on top of their API. This means that in the future if we want to split rent payments on either the collection or payout side, we have the right building blocks to do so seamlessly."

Gavin Servai, Co-Founder & CTO at SparrowSee How Fintech-as-a-Service Can Work For You

Get The Latest News In Fintech

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.