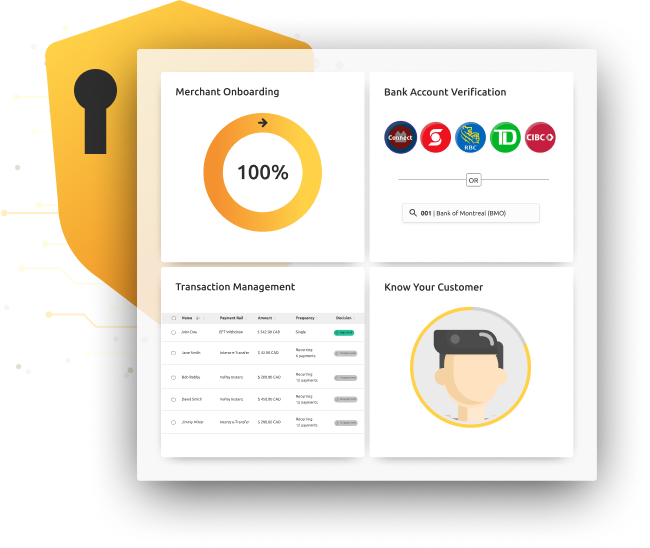

Strengthen Your Business Resiliance with Payment Risk Management Tools

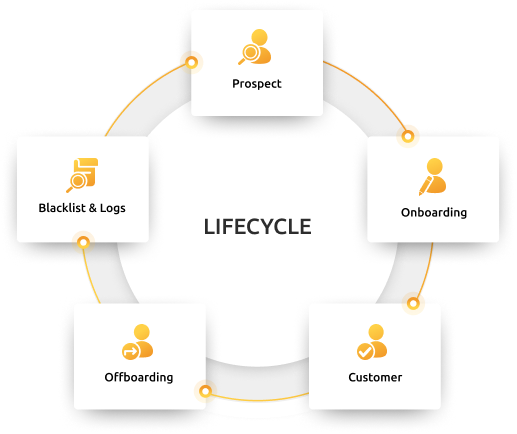

Effective risk management is crucial for any platform handling money, ensuring compliance, fraud protection, and customer trust.

Our platform supports thousands of businesses across North America with real-time monitoring, automated compliance, and advanced fraud prevention tools to keep operations secure and efficient.

Certified & Trusted Platform

Speak to a Fintech Specialist Today!

1. Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

2. Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

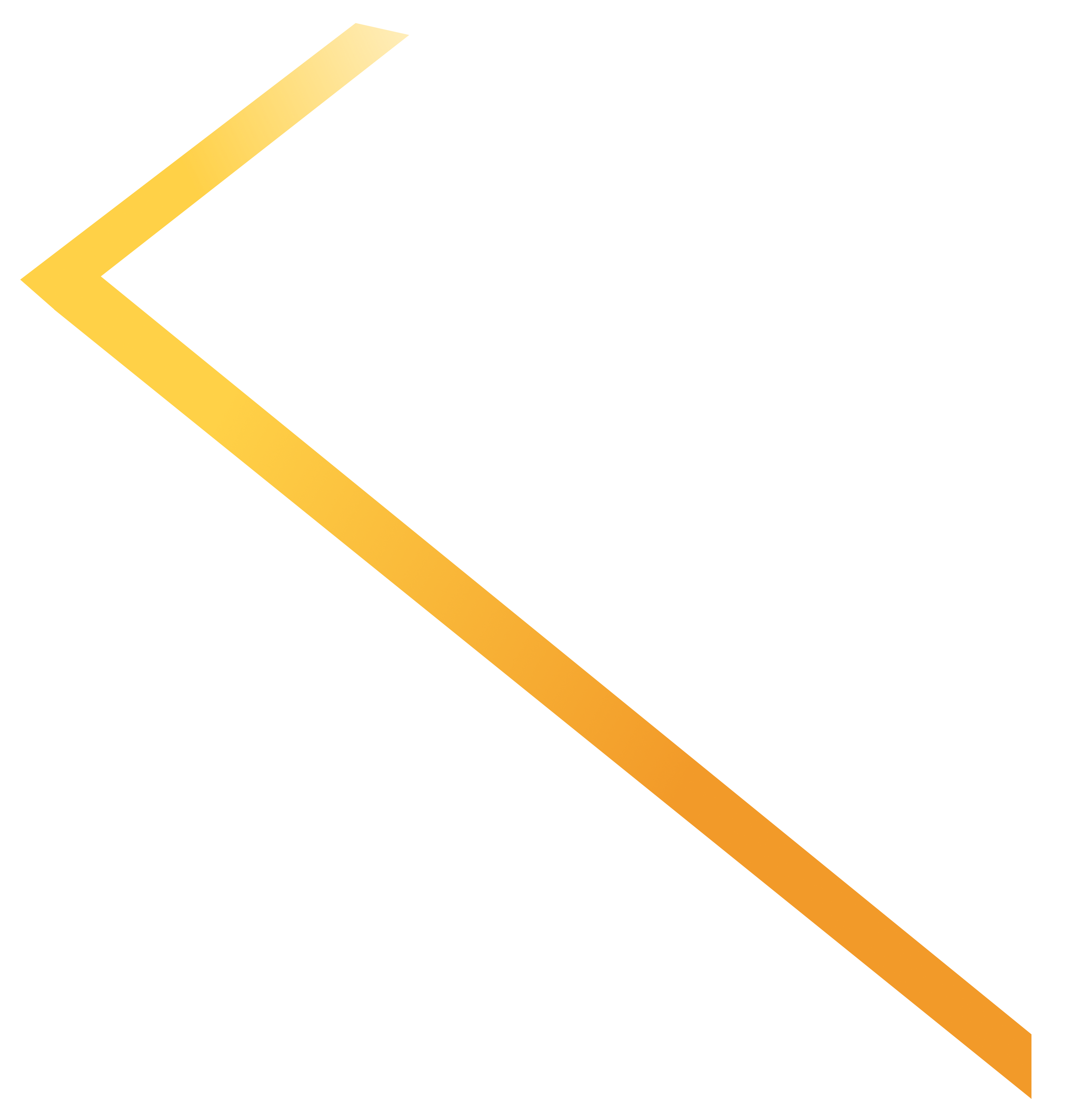

3. Sign & onboard

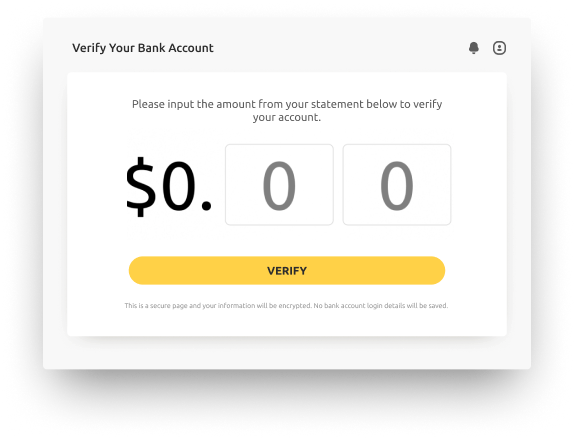

Our compliance and onboarding team will guide you through the process.

4. Go live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.