White-Label eCheck Processing For Business

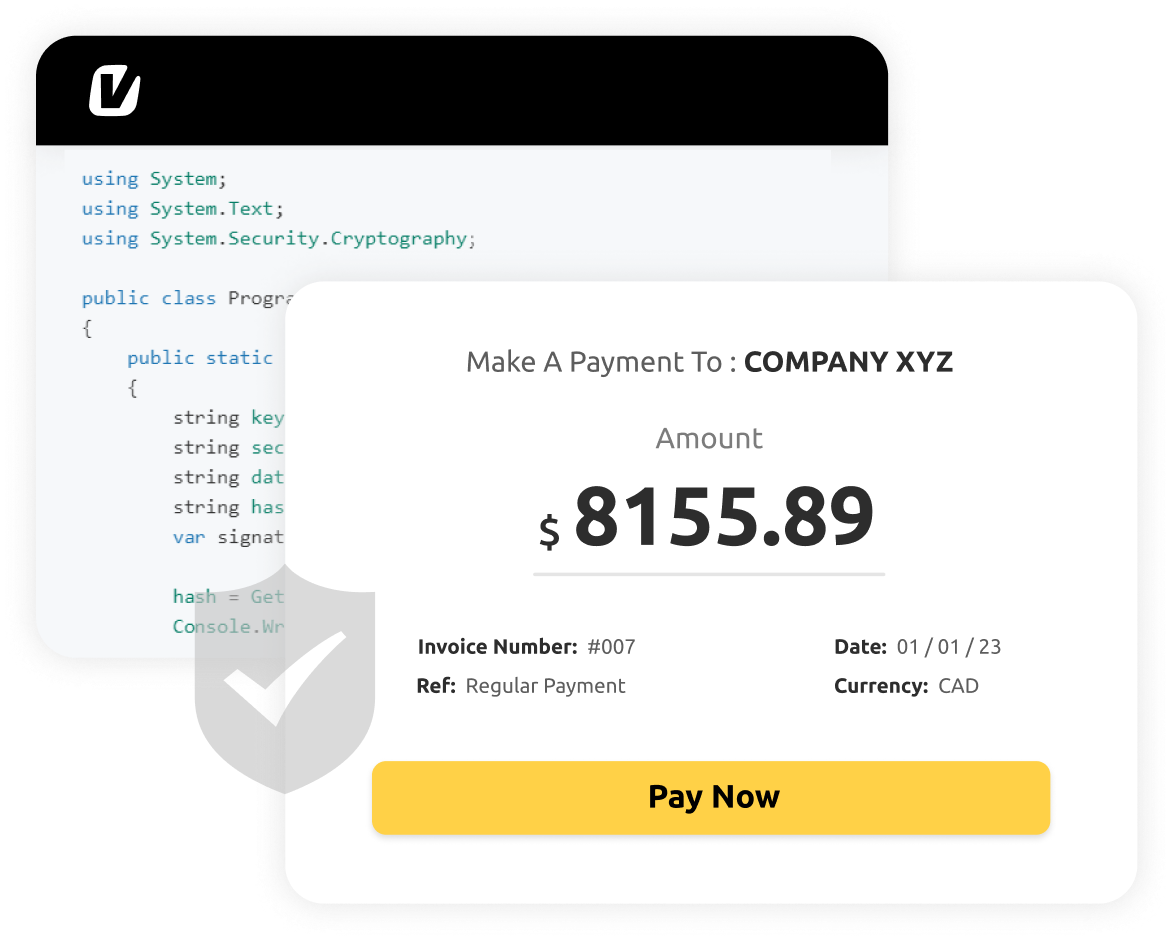

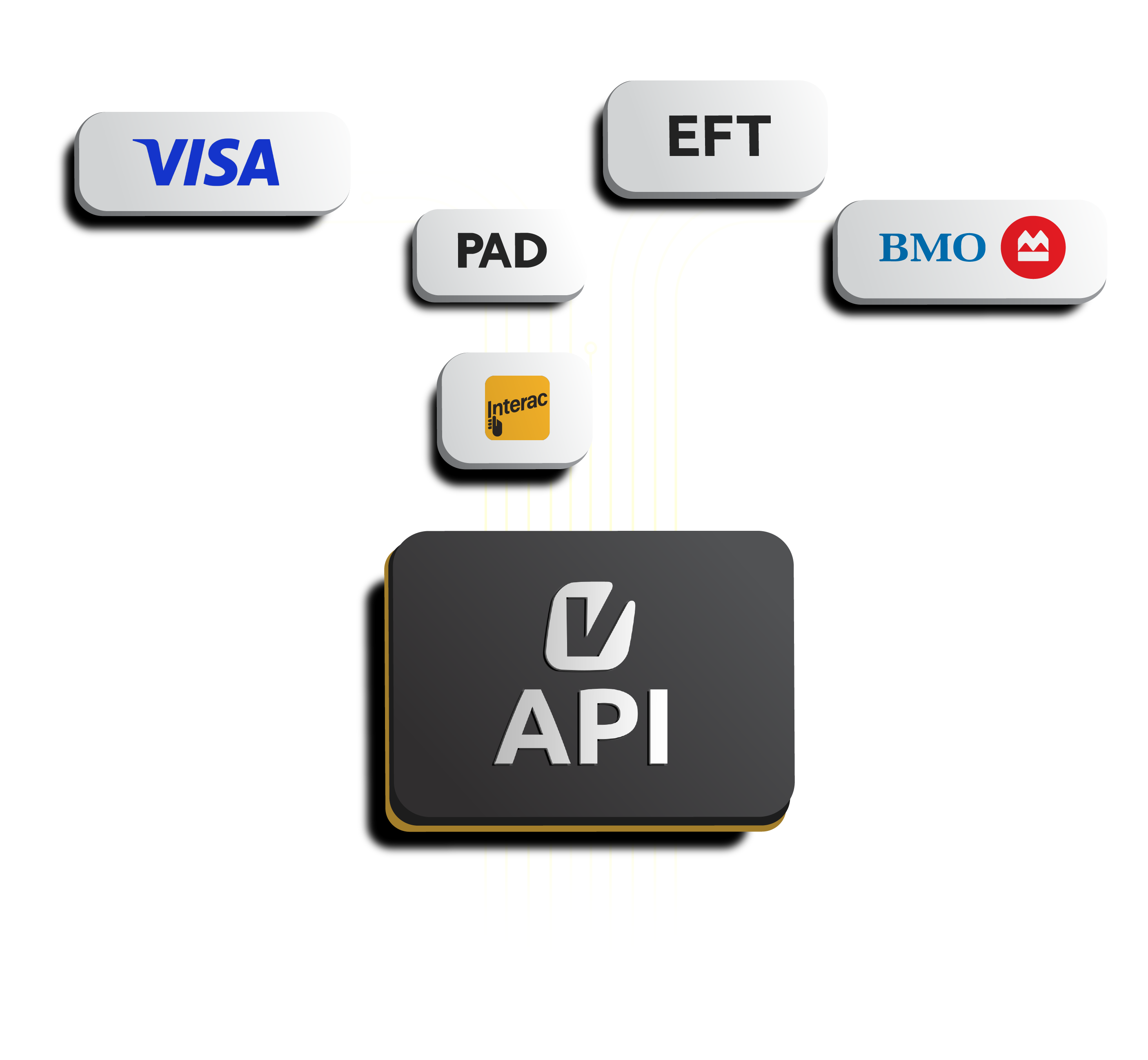

Send and receive funds using electronic check processing on the VoPay network using our dedicated Payment Portal or single API integration.

Allow customers to send payments electronically for safer and more transparent collections and utilize digital payouts for better money movement.

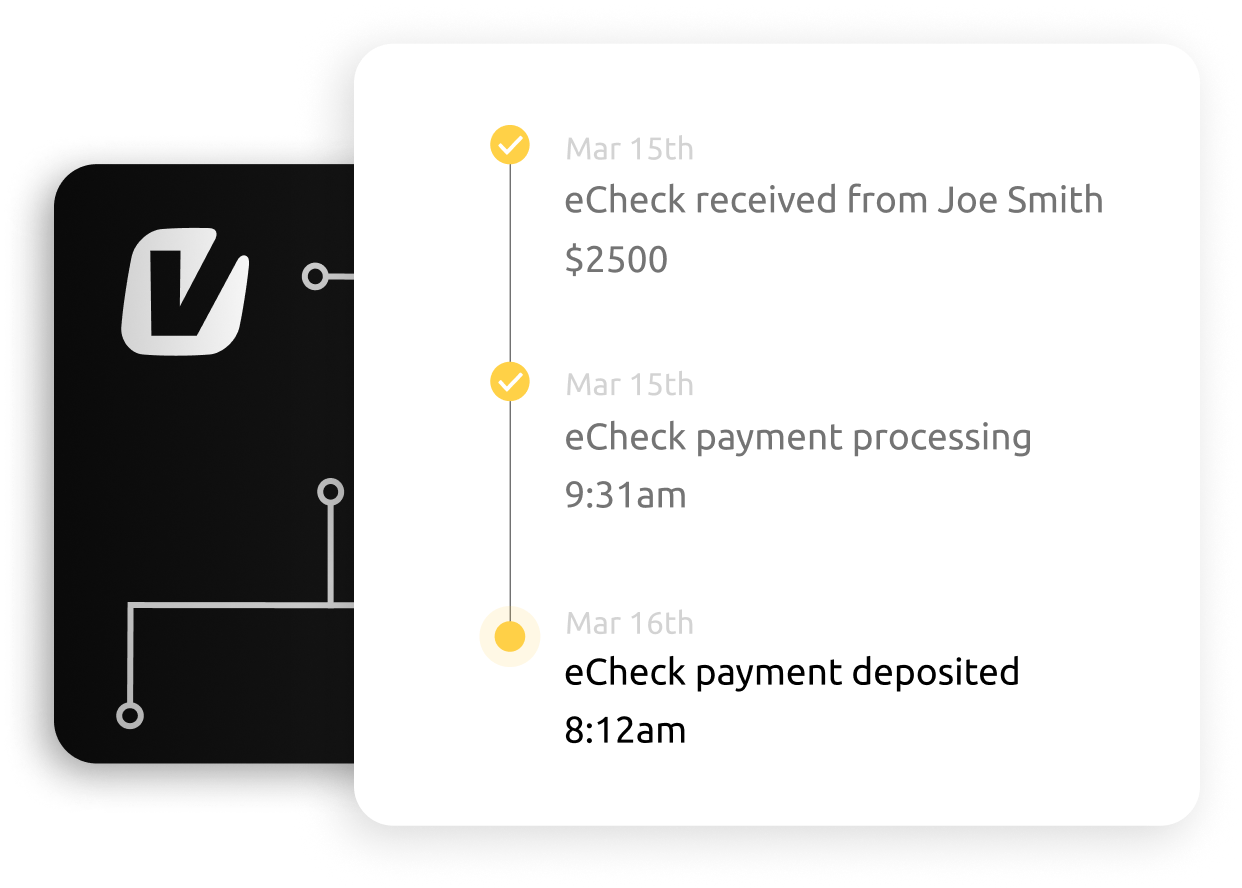

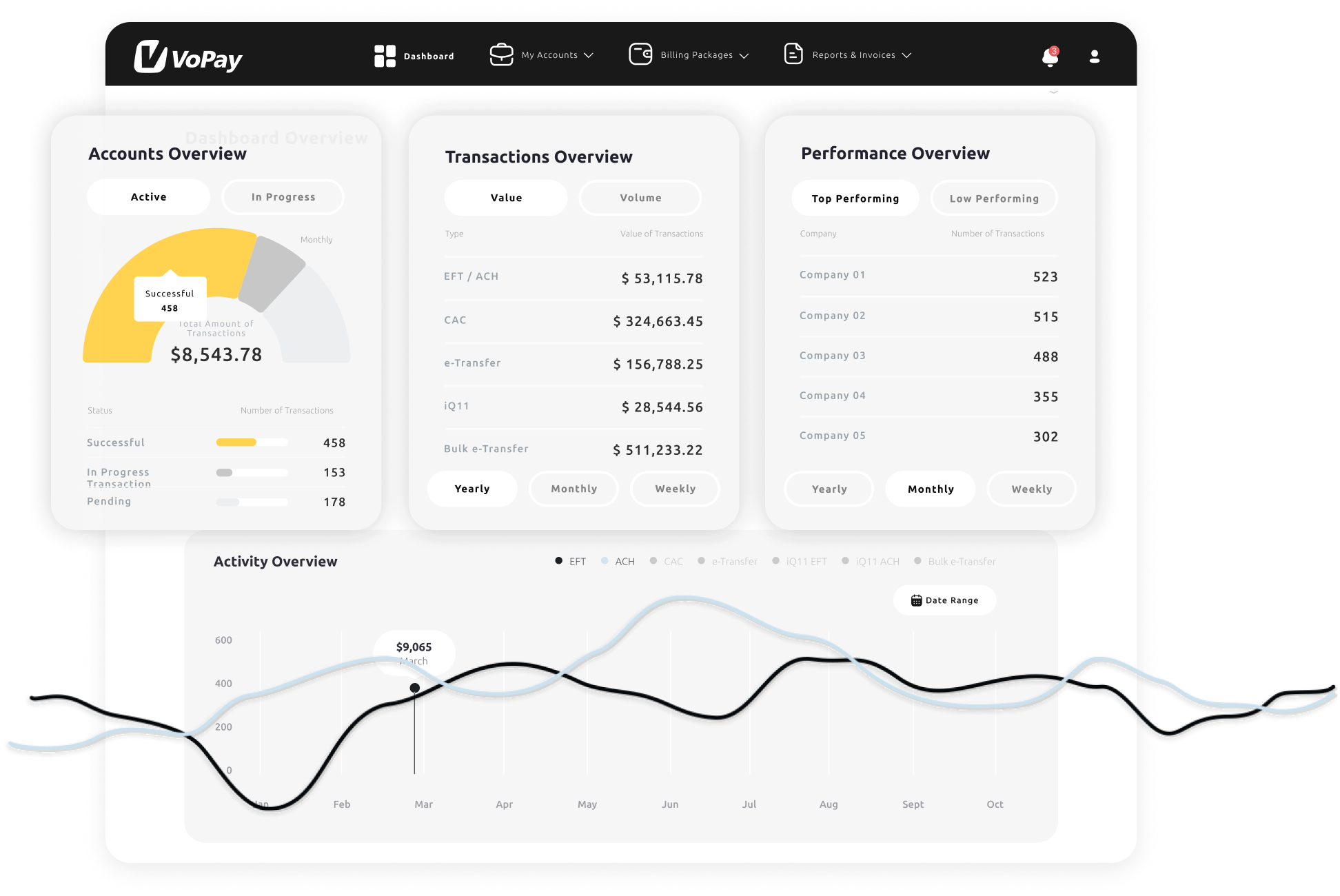

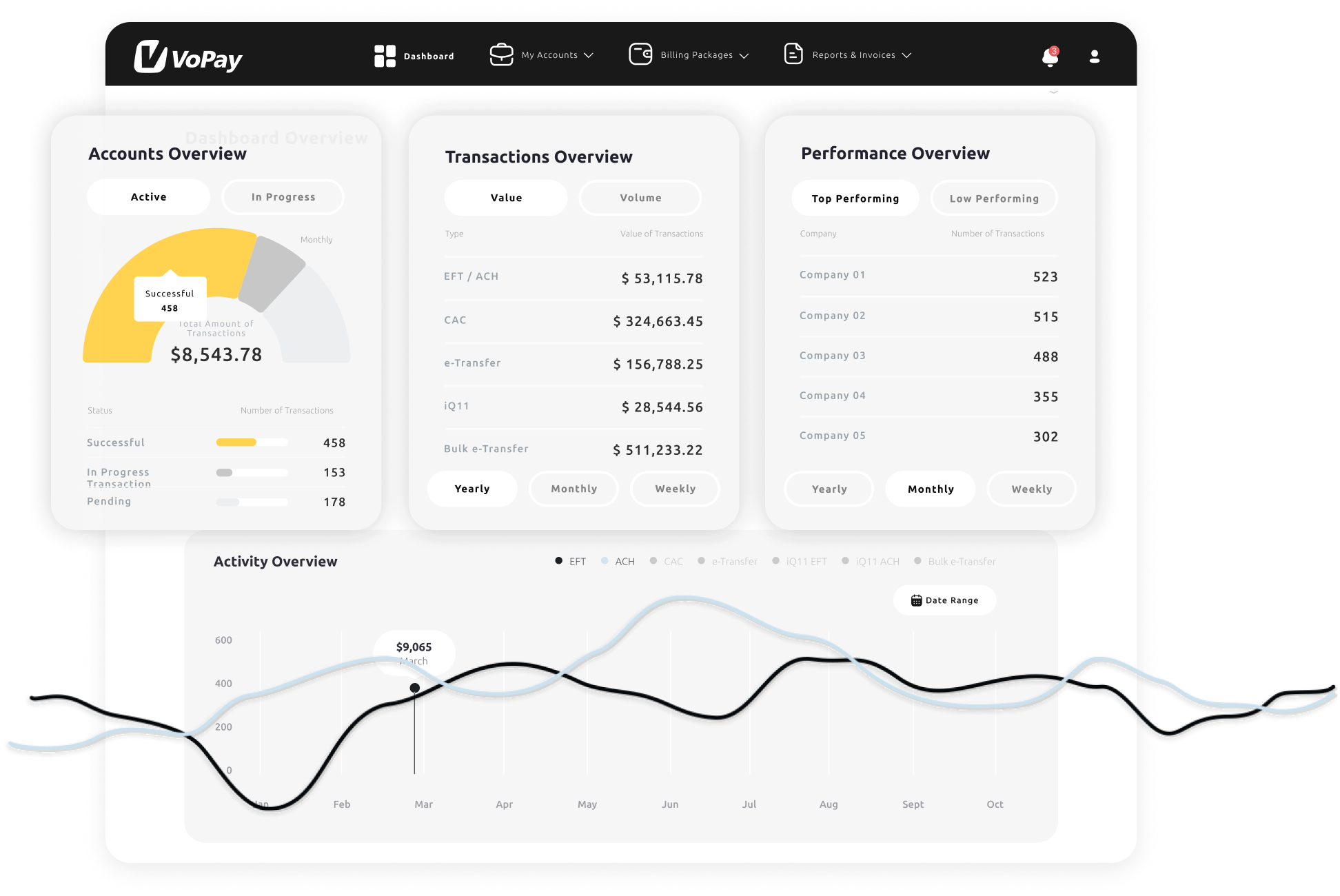

Manage Digital Check Payments From Our Dedicated Portal

Use our eCheck solution through our API integration or via our stunning Payment Portal, which can be used alongside the API or as a standalone interface for managing payments.

Monitor the status of your digital checks and keep track of all your payments from one centralized dashboard.

eCheck Frequently Asked Questions

Speak to a Fintech Advisor Today!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Onboarding Support

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.