Payments

Financial Tools

Process Automation

Risk & Compliance

-

Payment Rails

-

Bank Account Connectors

-

Payment Automation

-

Risk Management

-

Cross Border Payments

-

Accounting Integrations

-

AR/AP Automation

COMING SOON -

KYC/AML

COMING SOON -

Payment Links

-

Virtual Accounts

-

Approval Workflows

-

Onboarding

-

Open Data Payments

COMING SOON -

Ledger Management

-

Micro-Deposits & Verification

-

Transaction Monitoring

COMING SOON

Organizations

Developer Zone

-

The Sandbox

-

Developer Documentation

-

Integration Recipes

-

Status Updates

-

Blog

-

About VoPay

-

Case Studies

-

Careers

-

Newsroom

-

Contact Us

-

Resources

NEW -

FAQ

Learn

Company

- Products

- Solutions

- Developers

- Partners

- Resources

The Payment Powerhouse built For Lending Platforms

Use our Payments-as-a-Service solution to monetize the funding and collection of loans on your lending application.

Our managed services allow loan management platforms to rapidly deploy payments and financial services, shortcutting your time to revenue generation, and offloading compliance and regulatory processes.

Fund Faster On Your Lending Platform

Our single-layer payment API is designed to give lending platforms the tools they need to build, perfect and scale their lending operations.

Accept Partial

Payments

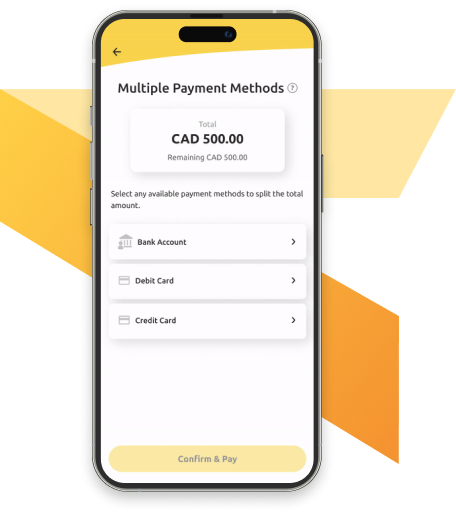

Accept Partial Payments

Give borrowers the flexibility to pay loans partially or in full for a better lending experience.

Fund In

Real-Time

Fund In Real-Time

Send loans to borrowers instantly to meet market expectations and increase customer satisfaction.

Scheduled

Collections

Scheduled Collections

Automate repayments with scheduled collections that can be triggered once or on a recurring basis.

Bank Account

Verification

Bank Account Verification

Reduce failed payments and NSFs using eLinx to connect customer bank accounts and validate their balance.

Set up Unlimited Virtual Account Structures To Optimize The Flow Of Funds

Move and hold funds using dedicated accounts in a customized hierarchy unique to your loan management platform.

Unlimited virtual account structures for every lending use-case.

Example: A lending platform creates virtual wallets for both lenders and borrowers to maintain balances at the individual user level.

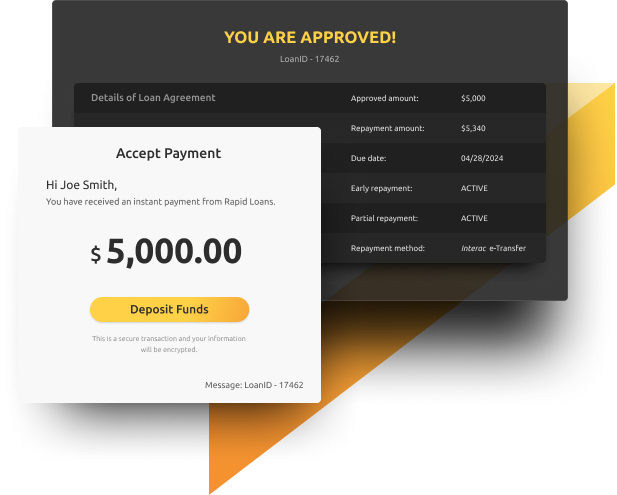

Deploy Smart Payment Links & Flexible Repayment Options

eLinx is our bundled customer onboarding, bank connection and payment link experience, perfectly optimized for loan management platforms and designed to be embedded into existing UIs or used standalone via email.

Offer lenders greater value and functionality with our flexible payment options that give borrowers more freedom to pay on their own terms, reducing missed payments and increasing satisfaction rates.

Manage Cash Flow with Multiple Payment Rails to Push & Pull Funds

Reduce defaults and missed payments by giving borrowers more ways to pay with instant Request Money, recurring EFT payments and partial repayment options.

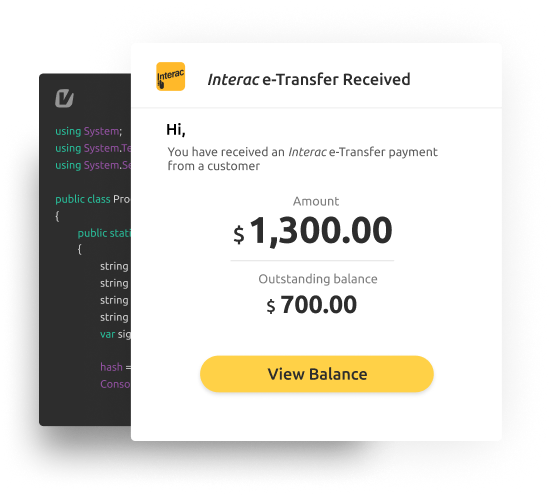

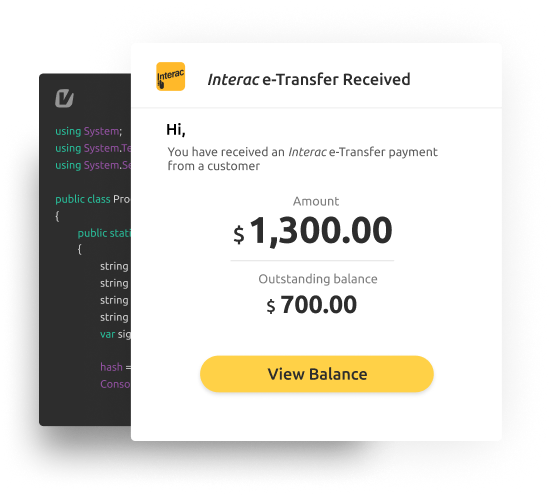

Interac e-Transfer allows lenders to fund loans in real-time and request repayments from customers using a payment method they like and trust.

Manage Cash Flow with Multiple Payment Rails to Push & Pull Funds

Reduce defaults and missed payments by giving borrowers more ways to pay with instant Request Money, recurring EFT payments and partial repayment options.

Interac e-Transfer allows lenders to fund loans in real-time and request repayments from customers using a payment method they like and trust.

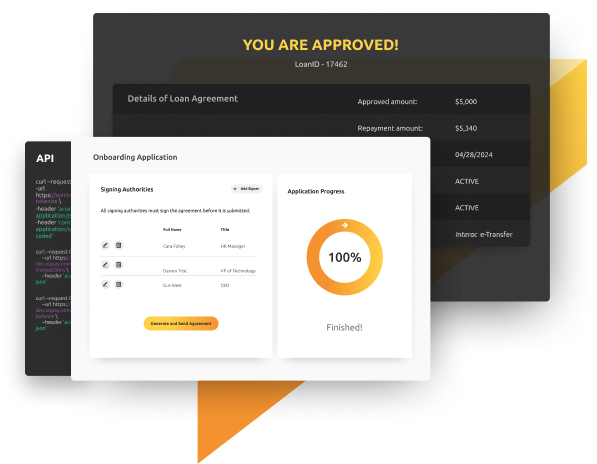

Payments, Risk & Automation On A single Lending API

Outsource the onboarding of new lenders, payments compliance, and risk mitigation to us with our fully-managed fintech services.

Our Payments-as-a-Service solution bundles payments, automation and risk intelligence into one dedicated toolkit designed to integrate with any lending platform in less than 3 weeks.

Made For Developers, By Developers

Do everything from a single-API layer on a platform designed to give developers the tools they need to create the perfect workflows and experiences.

Integrate multiple payment rails rapidly using our extensive API docs and use our dedicated lending recipe to accelerate development time.

- cURL

- JavaScript

- PHP

- Python

Made For Developers, By Developers

Do everything from a single-API layer on a platform designed to give developers the tools they need to create the perfect workflows and experiences.

Integrate multiple payment rails rapidly using our extensive API docs and use our dedicated lending recipe to accelerate development time.

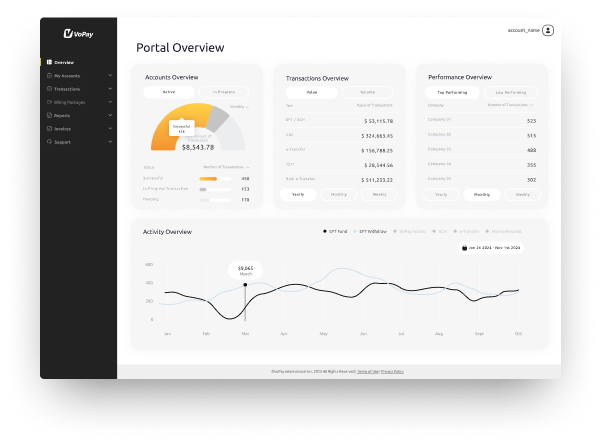

One Place To Manage Accounts & Operations

Monitor all your platform users and their transaction history from our dedicated Portal, designed to empower your business with rich transaction data & analytics.

Create new accounts, manage transactions, and set granular permissions based on business requirements so you are always in control.

Proudly Supported By Industry Leaders Across North America

Gary Schwartz

President of the CLA

“VoPay has demonstrated a strong record of providing innovative fintech services to Canadian lenders. We look forward to working with VoPay and the rest of our members to influence policy in a way that promotes transparency and fosters responsible and ethical lending practices nationwide”

Dmitry Voronenko

CEO of TurnKey Lender

“We’re excited to build a long-lasting and fruitful partnership with VoPay. Building a better future for financial technology is a global mega project in which companies like ours have a shared responsibility. Working together and combining efforts - makes the whole ecosystem safer, more efficient, and allows all of us to achieve more.”

Ivan Kovalenko

CEO of HES Fintech

“We are happy to start our strategic partnership with VoPay, a well-known Canadian-based provider of digital payments solutions. It allows is to offer customers fast and seamless integration to make their transactions secure and available anytime.”

Speak to a Fintech Specialist Today!

1. Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

2. Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

3. Sign & onboard

Our compliance and onboarding team will guide you through the process.

4. Go live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.