Payments

Financial Tools

Process Automation

Risk & Compliance

-

Payment Rails

-

Bank Account Connectors

-

Payment Automation

-

Risk Management

-

Cross Border Payments

-

Accounting Integrations

-

AR/AP Automation

COMING SOON -

KYC/AML

COMING SOON -

Payment Links

-

Virtual Accounts

-

Approval Workflows

-

Onboarding

-

Open Data Payments

COMING SOON -

Ledger Management

-

Micro-Deposits & Verification

-

Transaction Monitoring

COMING SOON

Organizations

Developer Zone

-

The Sandbox

-

Developer Documentation

-

Integration Recipes

-

Status Updates

-

Blog

-

About VoPay

-

Case Studies

-

Careers

-

Newsroom

-

Contact Us

-

Resources

NEW -

FAQ

Learn

Company

- Products

- Solutions

- Developers

- Partners

- Resources

Verify Bank Accounts In Real-Time With Micro-Deposits

Instant micro-transactions enable businesses to authenticate customer bank accounts in real-time, reducing the risk of fraud and enhancing the payment process.

Accelerate onboarding and improve the user experience on your platform while ensuring every customer bank account is valid and functional.

Use Instant Micro-Transactions To Accelerate Onboarding & Reduce Fraud

Verify In

Real-Time

Verify In Real-Time

Micro-deposits arrive in customer bank accounts instantly, so they can start using your services with no interuption.

Custom API

Implementation

Custom API Implementation

Access micro-deposit functions using our dedicated API endpoints, or from our user-friendly Portal.

Bank Account

Verification

Bank Account Verification

Micro-deposits offer robust verification of customer bank accounts to help reduce NSFs, fraud and risk exposure.

Proactive Fraud

Reduction

Proactive Fraud Reduction

Keep fraud at bay with custom workflows designed to enable multiple micro-transaction layers.

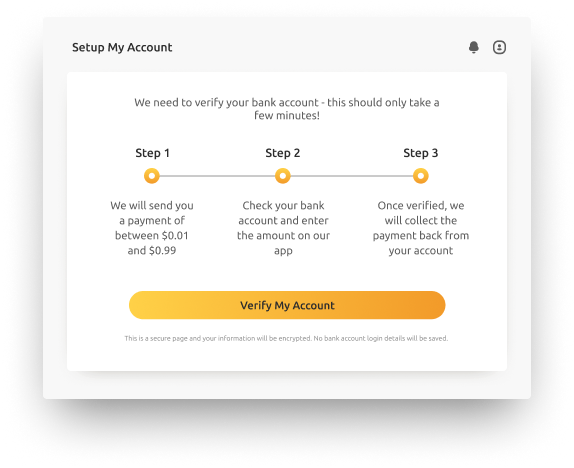

How Does Micro-Deposit Verification Work?

Initiate A

Verification

Initiate A Verification

Initiate a micro-deposit for a customer by using the API endpoint or through the VoPay Portal.

Micro-Deposit Is

Sent To Customer

Micro-Deposit Is Sent To Customer

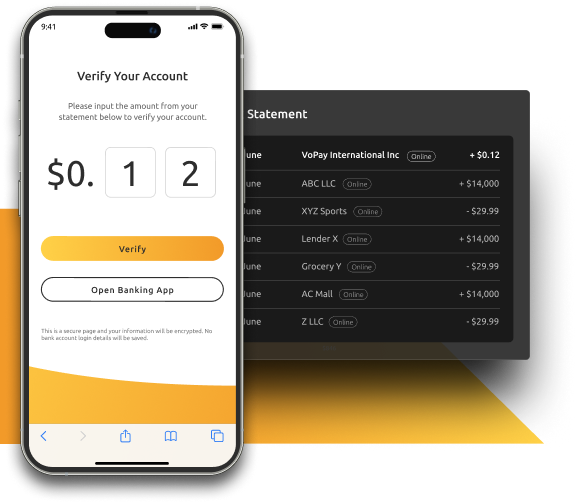

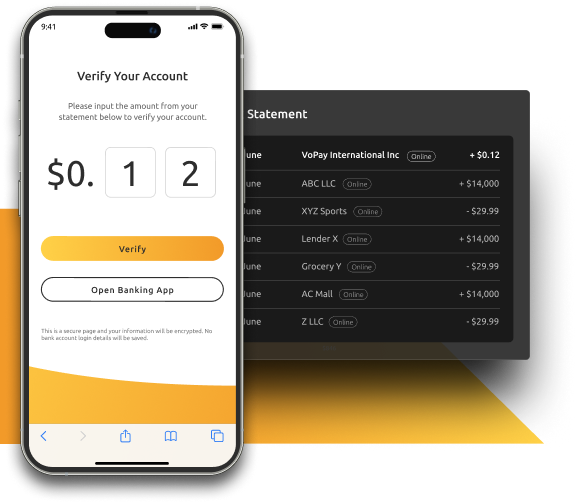

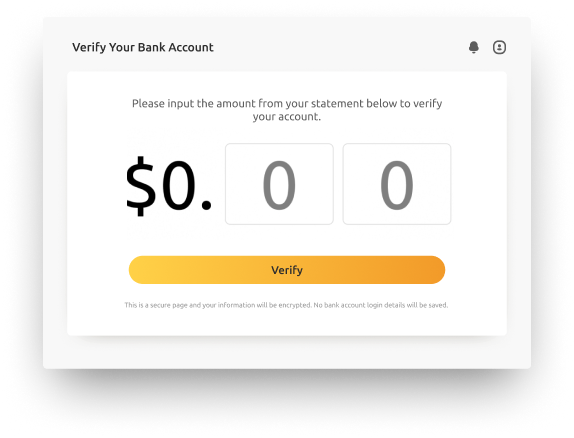

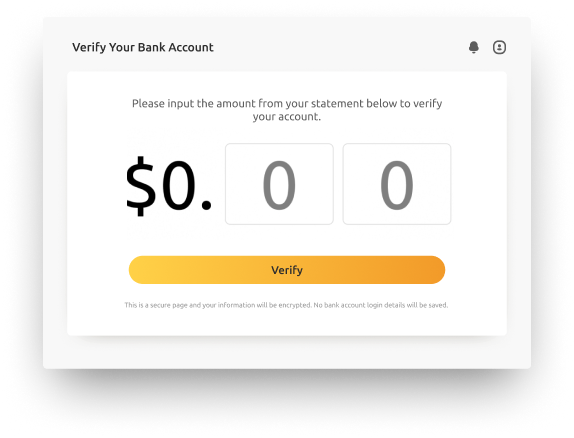

Customer provides bank account details and a random transaction amount is sent to their account.

Customer Validates

The Deposit

Customer Validates The Deposit

Customer receives an eLinx Verification request by email or URL and enters the amount they see in their bank account.

Bank Verification Is

Complete

Bank Verification Is Complete

Customers will have 3 attempts and 48 hours to enter the correct micro-deposit amount.

Secure Bank Verification, Now even Faster

A fast and frictionless verification process is needed if you want your customers to stick around, and a robust validation workflow is essential in order to mitigate risk and scale bank account payments on your platform.

The quicker you can verify and onboard new customers, the faster you can ramp up growth on your platform.

Secure Bank Verification, Now even Faster

A fast and frictionless verification process is needed if you want your customers to stick around, and a robust validation workflow is essential in order to mitigate risk and scale bank account payments on your platform.

The quicker you can verify and onboard new customers, the faster you can ramp up growth on your platform.

Push, Pull, and Layer Micro-Transactions Tailored to Your Use Case

As well as instant micro-deposits, we offer deposit and collection workflows in order to confirm debit permissions on your customer bank accounts.

And for increased fraud protection, our micro-transactions can be layered alongside each other so customers have to verify multiple deposits or credits in their account.

Validate User Bank Accounts In Any Vertical

Our integration recipes are designed to give businesses in any industry the tools build payments into their platform quickly and accurately.

Gig Economy

Use micro-deposits to confirm the authenticity of users and their bank accounts.

Lending

Validate borrowers’ bank accounts prior to funding to reduce the risk of default.

Property

Use micro-transactions to verify tenant accounts are correct and functional.

Account To Account

Send small deposits to unknown bank accounts to confirm ownership.

Payroll

Ensure employee bank account details are correct and prevent errors.

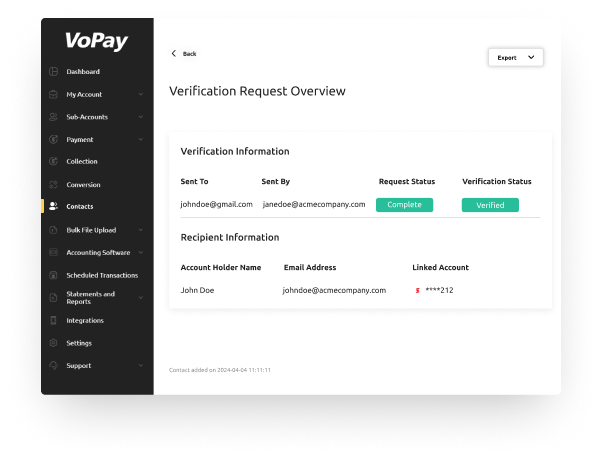

Manage Micro-Deposit Verification Using The VoPay Portal

Use the VoPay Portal to setup and manage micro-deposits for your contacts with just a few clicks.

Monitor the verification status of new accounts and utilize successful connections to start moving money with confidence.

Build a White-Label Product Using Our Payment API

Initiate and manage micro-deposit verification workflows using our dedicated micro-transaction endpoints.

Send multiple micro-deposit payments, verify them from within your own user interface, then collect them from verified accounts for a completely bespoke bank verification process.

- cURL

- JavaScript

- PHP

- Python

Build a White-Label Product Using Our Payment API

Initiate and manage micro-deposit verification workflows using our dedicated micro-transaction endpoints.

Send multiple micro-deposit payments, verify them from within your own user interface, then collect them from verified accounts for a completely bespoke bank verification process.

Frequently Asked Questions

Speak to a Fintech Specialist Today!

1. Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

2. Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

3. Sign & onboard

Our compliance and onboarding team will guide you through the process.

4. Go live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.