Payments

Financial Tools

Process Automation

Risk & Compliance

-

Payment Rails

-

Bank Account Connectors

-

Payment Automation

-

Risk Management

-

Cross Border Payments

-

Accounting Integrations

-

AR/AP Automation

COMING SOON -

KYC/AML

COMING SOON -

Payment Links

-

Virtual Accounts

-

Approval Workflows

-

Onboarding

-

Open Data Payments

COMING SOON -

Ledger Management

-

Micro-Deposits & Verification

-

Transaction Monitoring

COMING SOON

Organizations

-

Blog

-

About VoPay

-

Case Studies

-

Careers

-

Newsroom

-

Contact Us

-

Knowledge Hub

NEW -

FAQ

Learn

Company

- Products

- Solutions

- Developers

- Partners

- Resources

Strengthen Your Business Resiliance with Payment Risk Management Tools

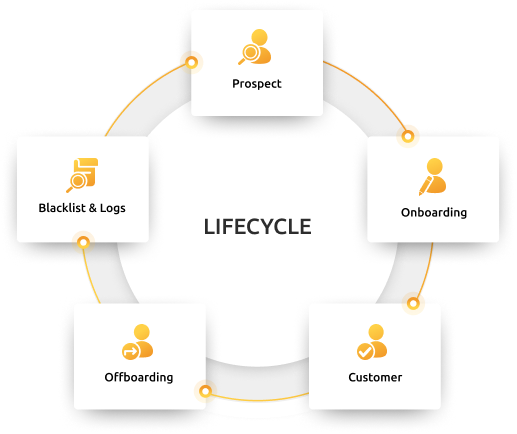

Effective risk management is crucial for any platform handling money, ensuring compliance, fraud protection, and customer trust.

Our platform supports thousands of businesses across North America with real-time monitoring, automated compliance, and advanced fraud prevention tools to keep operations secure and efficient.

Protect Your Business From

Payment Fraud

Protect Your Business From Payment Fraud

Reduce Fraudulent

Activity

Reduce Fraudulent Activity

Catch bad actors and fraudulent payments before they become problematic for your business.

Transaction

Monitoring

Transaction Monitoring

Our ongoing transaction monitoring processes can flag unusual activity and follow up with your team.

Managed Onboarding

Services

Managed Onboarding Services

Outsource onboarding and compliance activities such as KYC and AML processes to us.

Scale Without

Issues

Scale Without Issues

Implement rules and workflows so you can scale your business growth without being affected by risk activities.

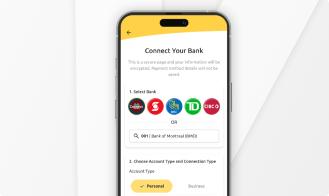

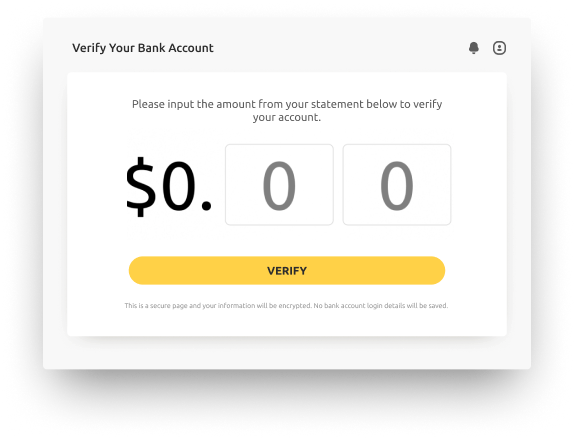

Bank Account Verification In Real-Time With Micro-Deposits

Instant micro-transactions let you authenticate customer bank accounts in real-time, reducing the risk of fraud and enhancing the payment process.

Accelerate onboarding and improve user experience on your platform, while ensuring every customer bank account is valid and functional.

Bank Account Verification In Real-Time With Micro-Deposits

Instant micro-transactions let you authenticate customer bank accounts in real-time, reducing the risk of fraud and enhancing the payment process.

Accelerate onboarding and improve user experience on your platform, while ensuring every customer bank account is valid and functional.

Built-In Tokenization & Encryption To Protect Your Transactions

Our tokenization protocols replace sensitive data, like bank account information and credit card numbers, with unique tokens that are useless to cybercriminals if intercepted.

All data moving across our platform is encrypted, adding an extra layer of protection and exceeding industry regulatory standards, giving you and your clients peace of mind.

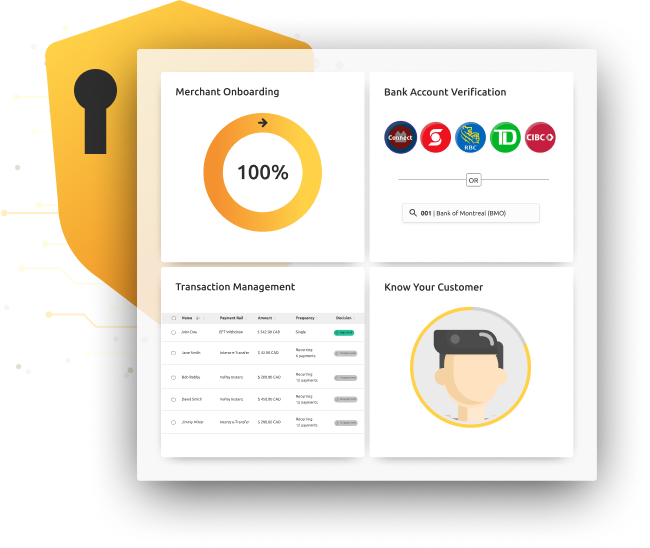

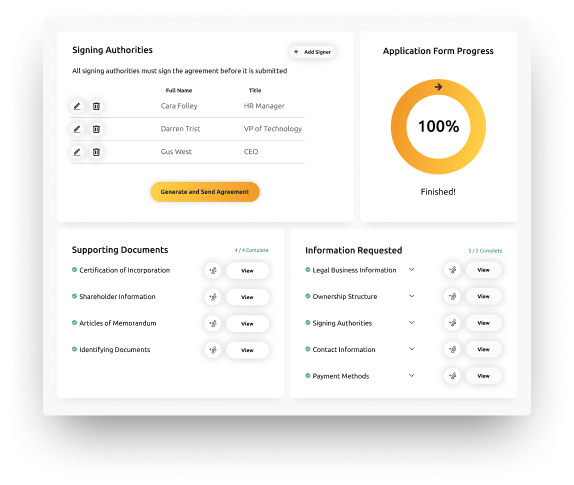

Outsource Your Compliance Activities To The Experts

Constantly evolving compliance regulations can be complex and intimidating for many businesses. By outsourcing these activities, they can focus on their core products and services without the added burden.

Our Compliance-as-a-Service solution manages mandatory regulatory requirements, including onboarding, underwriting, AML, and KYC, while also reducing the risk of fraud, fines, and business losses.

Outsource Your Compliance Activities To The Experts

Constantly evolving compliance regulations can be complex and intimidating for many businesses. By outsourcing these activities, they can focus on their core products and services without the added burden.

Our Compliance-as-a-Service solution manages mandatory regulatory requirements, including onboarding, underwriting, AML, and KYC, while also reducing the risk of fraud, fines, and business losses.

Transaction Monitoring, Screening & Analysis

Our platform offers comprehensive transaction monitoring, screening, and flagging processes to help businesses detect and prevent suspicious activity in real time.

Our platform offers comprehensive transaction monitoring, screening, and flagging processes to help businesses detect and prevent suspicious activity in real time.

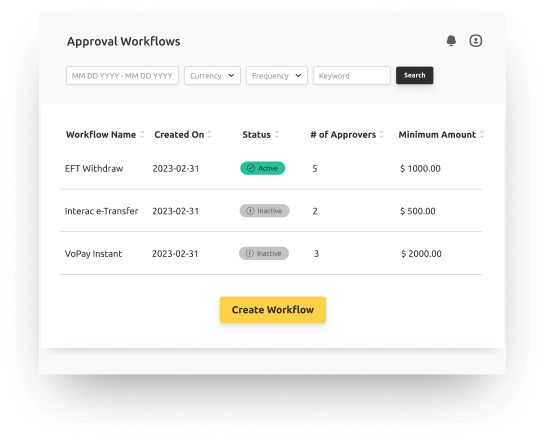

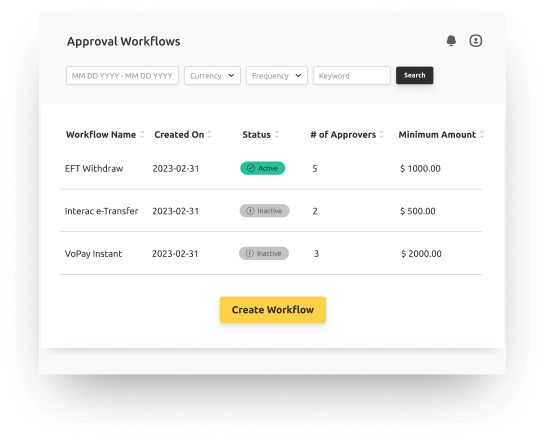

Set up Approval Workflows To Maintain Control Over Outgoing Payments

Reduce your exposure to unwanted financial risks by exercising control over outgoing transactions, using custom workflows designed to gate-keep your cash flow without slowing it down.

Set up individual workflows for specific payment rails, and implement rules such as the number of Approvers required, and the minimum amount at which the workflow will trigger.

Set up Approval Workflows To Maintain Control Over Outgoing Payments

Reduce your exposure to unwanted financial risks by exercising control over outgoing transactions, using custom workflows designed to gate-keep your cash flow without slowing it down.

Set up individual workflows for specific payment rails, and implement rules such as the number of Approvers required, and the minimum amount at which the workflow will trigger.

Certified & Trusted Platform

Talk to a Fintech Advisor Today!

1. Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

2. Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

3. Sign & onboard

Our compliance and onboarding team will guide you through the process.

4. Go live!

Choose a production date and launch your integration with confidence!

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.