Payments

Financial Tools

Process Automation

Risk & Compliance

-

Payment Rails

-

Bank Account Connectors

-

Payment Automation

-

Risk Management

-

Cross Border Payments

-

Accounting Integrations

-

AR/AP Automation

COMING SOON -

KYC/AML

COMING SOON -

Payment Links

-

Virtual Accounts

-

Approval Workflows

-

Onboarding

-

Open Data Payments

COMING SOON -

Ledger Management

-

Micro-Deposits & Verification

-

Transaction Monitoring

COMING SOON

Organizations

Developer Zone

-

The Sandbox

-

Developer Documentation

-

Integration Recipes

-

Status Updates

-

Blog

-

About VoPay

-

Case Studies

-

Careers

-

Newsroom

-

Contact Us

-

Resources

NEW -

FAQ

Learn

Company

- Products

- Solutions

- Developers

- Partners

- Resources

Accelerate Growth With White-Label Onboarding Workflows

Onboard new customers and businesses quickly and in a compliant manner using our white-label onboarding application.

Request KYC and ID verification from new users, and use a single endpoint on our application to simultaneously create a new account using a fully automated onboarding experience.

A Complete Onboarding Solution For Platforms & Enterprises

Fully Managed

Onboarding

Fully Managed Onboarding

We’ve built an entire onboarding experience that can be white-labelled and sent to your customers and clients.

Advanced KYC

Tools

Advanced KYC Tools

Request essential KYC documents from new users and manage them securely in a single location that can be requested via API.

Verify Multiple

Signers

Verify Multiple Signers

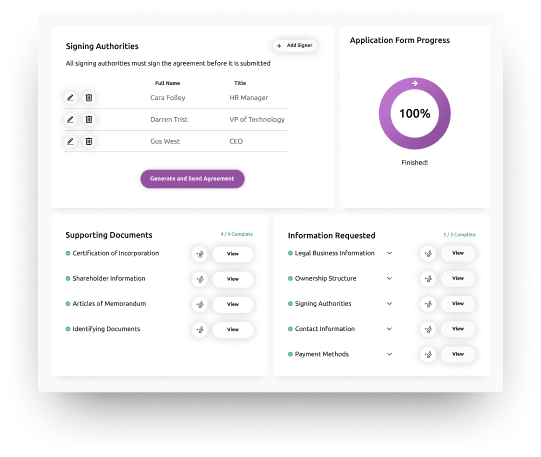

Collect documents from the required business stakeholders and collect their signature to complete the onboarding process.

Identity

Verification

Identity Verification

Our onboarding process requires users to submit the required documents and complete facial ID verfication.

How Does Onboarding Work With VoPay?

Generate Onboarding

Application

Generate Onboarding Application

Generate a new onboarding application and create a new client account simultaneously by hitting one endpoint on our API.

Applicant

Completes Form

Applicant Completes Form

The recipient then completes all the necessary details, including KYC and ID verification steps.

Bank Connection

Setup

Bank Connection Setup

The applicant can then be prompted to connect their bank account using our secure connection workflow.

Signers Complete

Form

Signers Complete Form

If multiple signers are required, the final step will be for them to sign and verify their details.

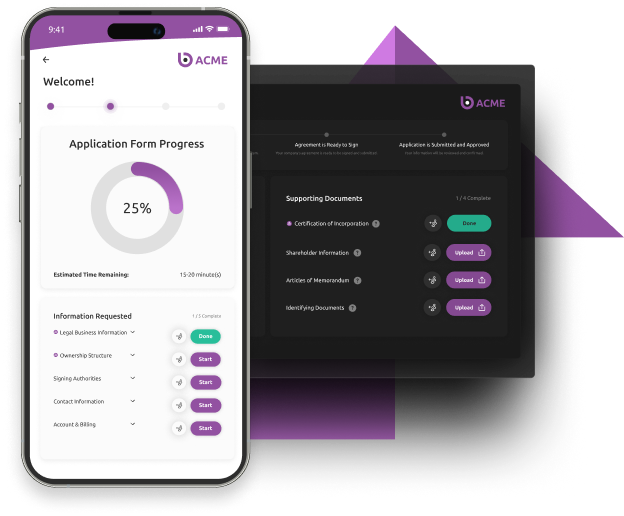

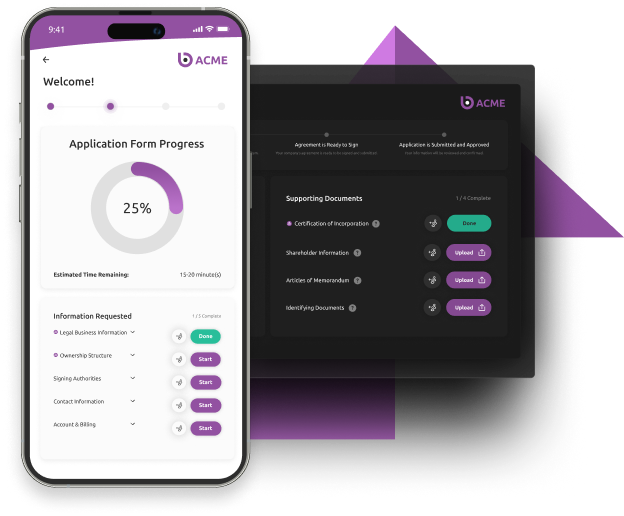

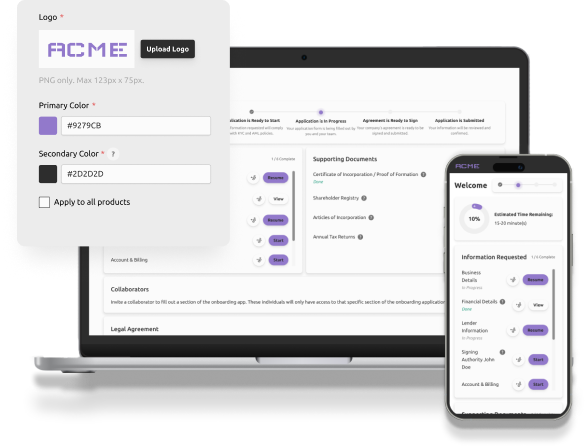

Create White-Label Onboarding Workflows For Your Customers

Use our white-label toolkit to brand and personalize the onboarding application experience for your users, ensuring brand integrity at every step of the process.

Get your own onboarding application that comes ready to go to collect user information in a secure and compliant manner.

Collect KYC Information To Remain Compliant

Let new clients submit essential KYC data, including business details and supporting documents, and give them the power to add stakeholders to any part of the process to assist in the completion of the form.

Allow users to save the application process at anytime and return to it when they are ready, giving a fully automated and streamlined onboarding experience.

Collect KYC Information To Remain Compliant

Let new clients submit essential KYC data, including business details and supporting documents, and give them the power to add stakeholders to any part of the process to assist in the completion of the form.

Allow users to save the application process at anytime and return to it when they are ready, giving a fully automated and streamlined onboarding experience.

Block Bad Actors With ID Verification and Fraud Detection tools

Generate onboarding experiences that start with an ID verification step that requires applicants to record a video of their face and upload an accepted piece of ID.

Automate ID verification and control your risk exposure to reduce the likelihood of fraudsters or bad actors gaining access to your platform.

Compliance Tools For Any Industry

VoPay’s compliance tools can be leveraged across multiple industries.

Gig Economy

Verify new

businesses and gig workers quickly and efficiently.

Verify new businesses and gig workers quickly and efficiently.

Lending

Onboard new

lenders onto your lending management platform.

Onboard new lenders onto your lending management platform.

Property

Automate the onboarding of landlords and real estate agencies.

Account To Account

Setup unlimited accounts in any hierarchy for complete A2A payment freedom.

SaaS

Compliant onboarding for software platforms that want to scale quickly.

Create Onboarding Workflows Via The VoPay API

Hit a single endpoint on our API to simultaneously create a new account and send out the corresponding onboarding application.

Embed onboarding workflows into your platform, and use parameters to set the account type and permissions.

- cURL

- JavaScript

- PHP

- Python

Create Onboarding Workflows Via The VoPay API

Hit a single endpoint on our API to simultaneously create a new account and send out the corresponding onboarding application.

Embed onboarding workflows into your platform, and use parameters to set the account type and permissions.

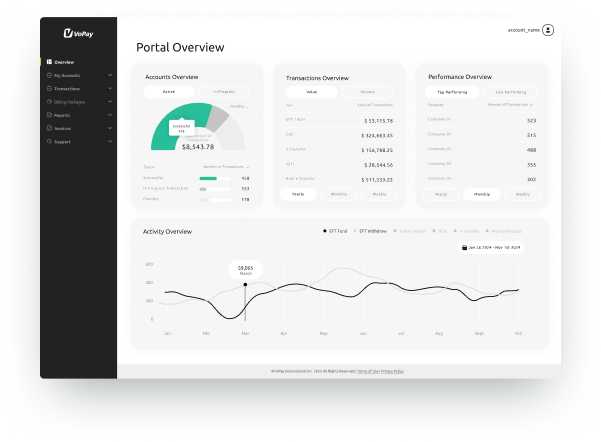

Manage Onboarding & Accounts From Our Online Portal

Our user-friendly portal gives you complete visibility of all your accounts, onboarding applications and user permissions.

Use our portal as a standalone solution for onboarding, or combine with our API to empower teams and scale your business effortlessly.

Speak to a Fintech Specialist Today!

1. Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

2. Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

3. Sign & onboard

Our compliance and onboarding team will guide you through the process.

4. Go live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.