Payments

Financial Tools

Process Automation

Risk & Compliance

-

Payment Rails

-

Bank Account Connectors

-

Payment Workflows

-

Risk Management

-

Cross Border Payments

-

Accounting Integrations

-

AR/AP Automation

COMING SOON -

KYC/AML

COMING SOON -

Payment Links

-

Virtual Wallets

-

Approval Workflows

-

Onboarding

-

Open Data Payments

COMING SOON -

Ledger Management

-

Micro-Deposits & Verification

-

Transaction Monitoring

COMING SOON

Developer Zone

-

The Sandbox

-

Developer Documentation

-

Integration Recipes

-

Status Updates

-

Blog

-

About VoPay

-

Case Studies

-

Careers

-

Newsroom

-

Contact Us

-

Resources

NEW -

FAQ

Learn

Company

- Products

- Solutions

- Developers

- Partners

- Resources

Powering Financial Innovation For Modern Enterprises

Businesses across North America use our Fintech-as-a-Service platform to enhance their financial processes and bring new products and services to market in record time.

From payments to cash management, we help automate and digitize financial workflows for both you and your customers so you can focus on your core business.

One Platform To Centralize Your Enterprise’s Financials

Connect the dots with a platform that unifies your payment operations and business processes.

Rapid

Integration

Rapid Integration

Fastrack your deployment time using our low-code and no-code options to get control of your enterprise finances quickly.

Real-Time

Visibility

Real-Time Visibility

Monitor cash flow in real-time to make informed decisions for better cash management.

Outsourced

Compliance

Outsourced Compliance

Leave payment regulations to us, so you can manage money on behalf of your partners as well as your own business.

Scalable

Platform

Scalable Platform

Scale efficiently and future-proof your enterprise without having to rebuild crucial systems as you grow.

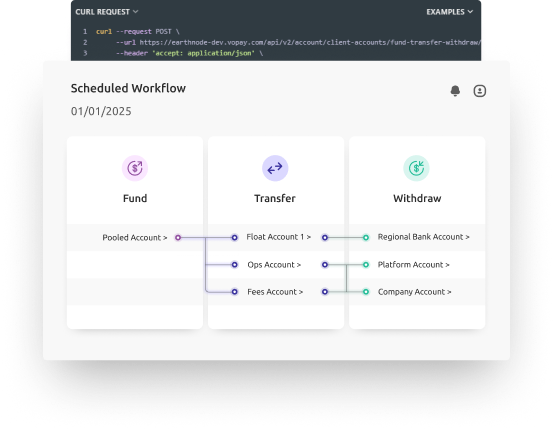

Automate Everything using Our Suite Of Enterprise Tools

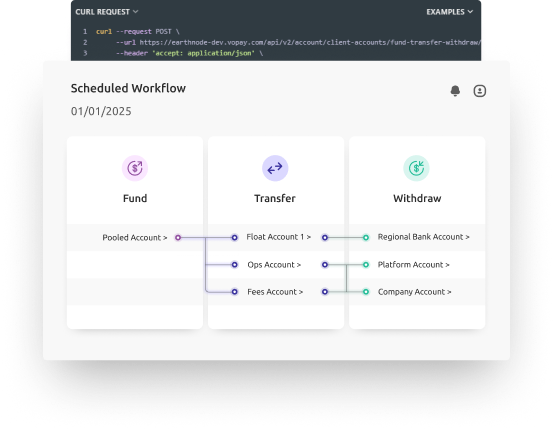

Whether you're managing transactions at scale or complex payment workflows, our business automation tools ensure consistency and accuracy at every step.

Deploy our pre-built workflows to manage recurring payments, transaction schedules, split payments, and chained transactions.

Automate Everything using Our Suite Of Enterprise Tools

Whether you're managing transactions at scale or complex payment workflows, our business automation tools ensure consistency and accuracy at every step.

Deploy our pre-built workflows to manage recurring payments, transaction schedules, split payments, and chained transactions.

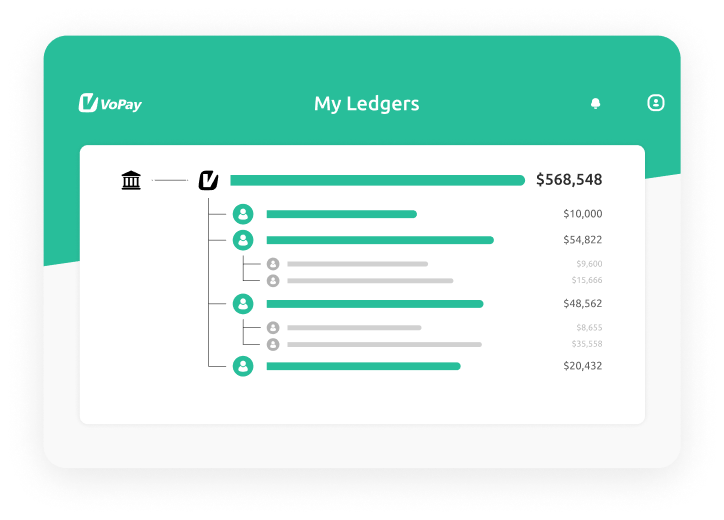

Manage Cash With Certainty Using Our Multi-Level Account Framework For Enterprises

Our ledger management technology lets enterprises create individual ledgers for business departments and operations, letting them segregate funds and optimize cash management.

Recreate complex organizational hierarchies with our multi-level account framework, automate reconciliation, and deploy virtual accounts for customers and partners.

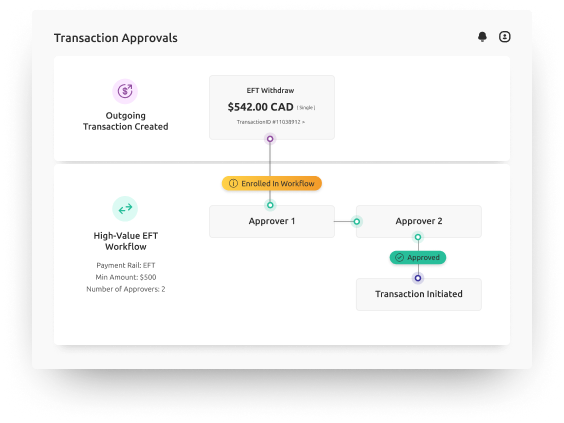

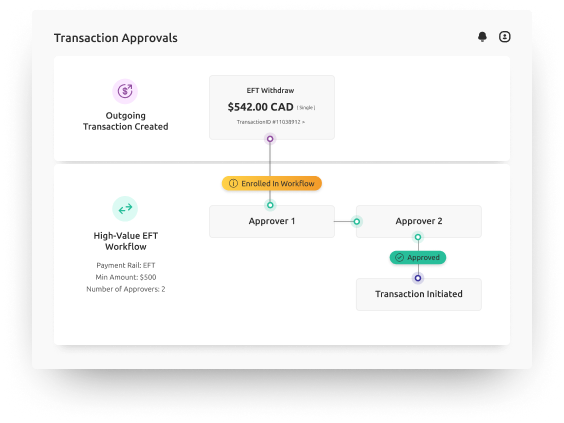

Control Cash Flow using Transaction Approval Workflows

Ensure that high-value transactions are reviewed and authorized with a robust approval process that doesn’t slow down your business or your cash flow.

Prevent errors, reduce fraud, and ensure industry compliance with role-based approval workflows that give businesses granular control over transaction amounts and payment networks.

Control Cash Flow using Transaction Approval Workflows

Ensure that high-value transactions are reviewed and authorized with a robust approval process that doesn’t slow down your business or your cash flow.

Prevent errors, reduce fraud, and ensure industry compliance with role-based approval workflows that give businesses granular control over transaction amounts and payment networks.

Connect Accounting Software To Automate Billing & Reconciliation

Integrate your accounting software with VoPay for seamless, real-time synchronization between your payments and bookkeeping systems.

Automatically import bills into VoPay to streamline payable settlements, and efficiently collect outstanding invoices through our robust payment rail network.

Connect Accounting Software To Automate Billing & Reconciliation

Integrate your accounting software with VoPay for seamless, real-time synchronization between your payments and bookkeeping systems.

Automatically import bills into VoPay to streamline payable settlements, and efficiently collect outstanding invoices through our robust payment rail network.

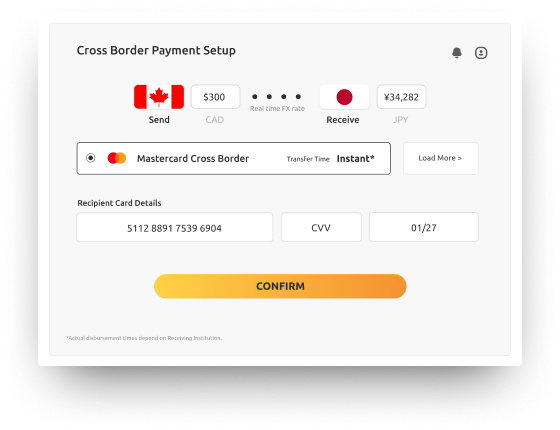

Tap Into Cross-Border Transactions & Maximize Your Global Reach

Expand your enterprise’s horizons with VoPay’s cross-border payment solutions, managed compliance services, instant payment rails and more.

Break down barriers to global growth, unlock new market opportunities, and integrate in just a few weeks, thanks to our international partnership with Mastercard.

The Fintech API For Scaling Business Operations

Our fintech API gives developers the power to build and white-label payment operations based on the internal architecture of their enterprise.

Integrate in record time with our comprehensive dev docs and industry recipes, with complete peace of mind thanks to our 99.99% API uptime.

- cURL

- JavaScript

- PHP

- Python

The Fintech API For Scaling Business Operations

Our fintech API gives developers the power to build and white-label payment operations based on the internal architecture of their enterprise.

Integrate in record time with our comprehensive dev docs and industry recipes, with complete peace of mind thanks to our 99.99% API uptime.

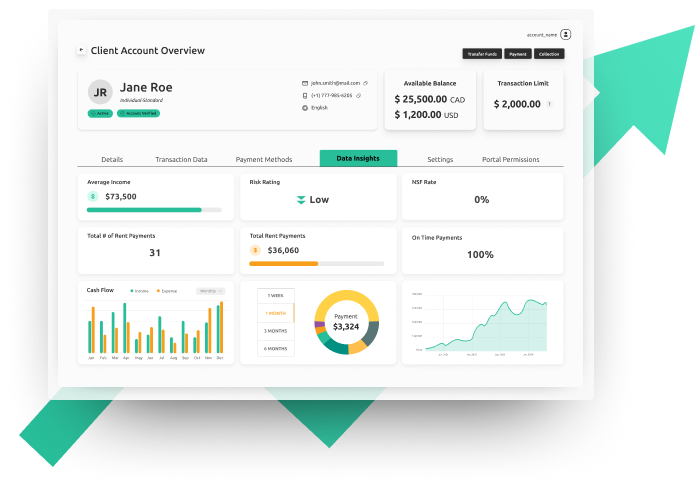

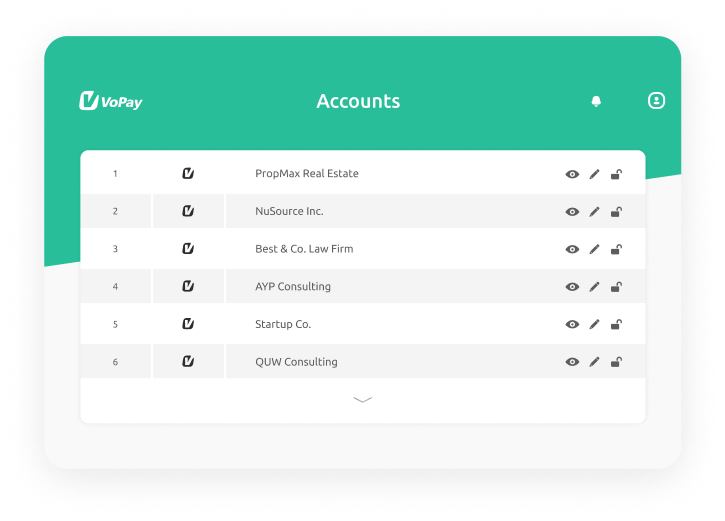

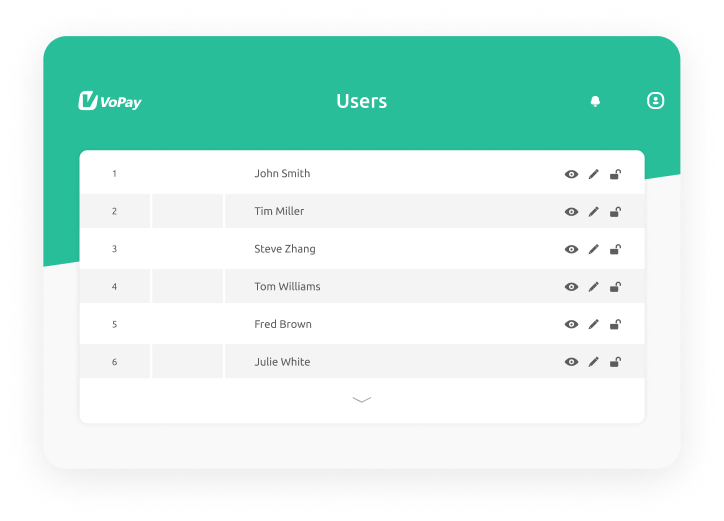

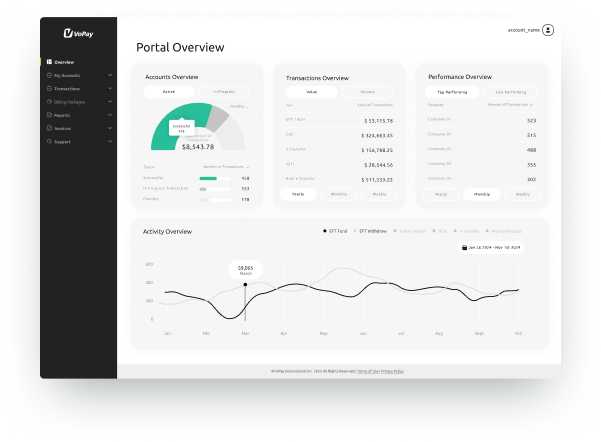

Access VoPay’s white-Label Portals for Full Financial Control & Visibility

We offer white-label online portals designed to serve a wide range of stakeholders within your enterprise ecosystem, including your customers, internal teams, and partners.

Manage everything from new accounts to transaction approvals, with granular controls for payment limits and user access, so you remain in control of your enterprise payments.

Speak to a Fintech Specialist Today!

1. Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

2. Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

3. Sign & onboard

Our compliance and onboarding team will guide you through the process.

4. Go live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.