Intro

Headquartered in British Columbia, Parvis stands out as a leading Exempt Market Dealer platform, transforming real estate investment by making high-quality opportunities accessible to a broader audience. Boasting a portfolio that ranges from local development projects to large real estate funds managing over $300 million and encompassing 20 to 40 properties nationwide, Parvis is breaking down the barriers to a market traditionally viewed as exclusive. Licensed across all provinces, Parvis offers its diverse investment products across the Canadian market, navigating the country's complex regulatory landscape with ease, thanks to VoPay's advanced payment technology. This integration keeps Parvis at the forefront of the digital era —setting a new standard for the industry.

The Problem

“This market, private lending and private real estate is opaque and paper-driven. It is full of PDFs and “you know, a guy who can invest you in a product.” It's very much that sort of world. And Parvis has built this platform that takes all of that and simplifies it in a way that I can't believe hasn't been done before.”

Industry insiders often joke that real estate investing has barely evolved from the days of making trades by phone and waiting days for postal confirmation before starting the bank payment process.

In today’s world, setting up a wire transfer or navigating an EFT through a financial institution presents barriers to investors. The drawn-out procedures, such as a month-long fund registration, lead to investor frustration and disengagement. What starts as an exciting investment opportunity quickly becomes a cumbersome ordeal. Parvis is acutely aware of this issue; recognizing that increased complexity leads directly to higher rates of customer drop-off.

Core Challenges Identified

1. Enhancing Transaction Ease and Speed on the Platform

Investors currently face a cumbersome and time-consuming process to complete transactions. This hinders the investment experience, impacting both investor attraction and retention.

2. Reducing Payment Processing Time from Weeks to Days

The extended duration required to process payments creates a significant bottleneck in investment fluidity. This delay affects investor satisfaction and the agility of capital movement, which is critical for timely investments.

3. Scaling the Organization Efficiently

As Parvis aims to expand its reach and service offerings, the challenge is scaling operations effectively without proportionately increasing the size of the workforce. Achieving growth while preserving operational efficiency and maintaining a lean team becomes a balancing act of resource management and technological leverage.

4. Differentiating Parvis in a Competitive Market

Parvis faces the challenge of standing out among competitors. Identifying and implementing distinctive features that offer clear value to investors is a must to attract and retain clientele in a competitive landscape.

5. Simplifying the Investor Onboarding Experience

The current investor onboarding process may be complex and intimidating, especially for new investors. Simplifying this experience is essential to lower the barrier to entry, encourage broader participation, and ensure a smooth transition for investors into the platform.

6. Adapting a Payment Solution to Navigate Diverse Provincial Regulations

Canada's provincial regulatory diversity poses a unique challenge in implementing a uniform payment solution that complies with varying local laws. Finding a payment system that can adapt to these diverse regulatory requirements is critical for offering a consistent and compliant service across all provinces.

Parvis was looking for a payment solution that could help them do it all.

By entering into a payment partnership with VoPay, they found what they were looking for and achieved much more than they expected.

The Solution

It’s working precisely as it should, delivering a much-needed digital solution for today's online-savvy investors. Users on the platform are choosing VoPay’s advanced EFT payment option due to its simplicity and effectiveness.

The partnership with VoPay emerged as the key to overcoming the organization’s payment challenges. By leveraging VoPay's unified payment solution, Parvis has dramatically simplified and accelerated the investment process. This partnership has allowed Parvis to grow, bringing new developers and funds into the mix.

VoPay's EFT payment option has become the go-to method for the platform's users to invest in smaller investment opportunities. In fact, close to 50% of the platform's financial transactions are now processed through VoPay.

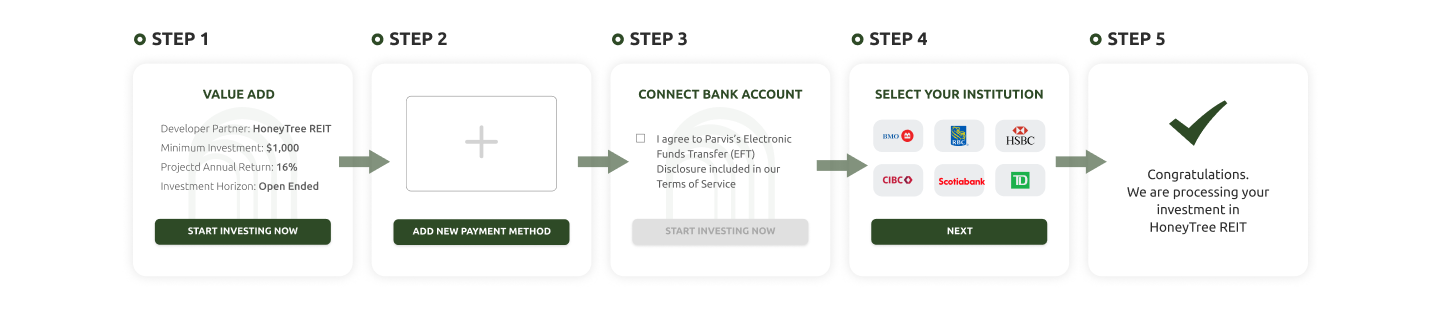

How It Works

"VoPay's EFT payment technology has streamlined our transactions significantly, minimizing our need to intervene. Investors can securely enter their banking information, click 'pay,' and complete their transaction immediately. This streamlined process is crucial for our lean team, removing the burden of manual tasks, form collection, and data re-entry. We now have clear and transparent transactions at our fingertips—a major advantage. Our goal is to build a scalable operation without needing a large accounting department. With VoPay, we're achieving that, making it possible for just one person to manage the process."

Scott Spence, Head of Growth, ParvisThis strategic payment partnership has fulfilled Parvis’s immediate needs and positioned the company for sustained growth and continued innovation in the real estate investment industry.

The Results

“It's essentially a scalable payment method that this industry just hasn't had.”

The integration of VoPay's EFT payment technology has catalyzed significant growth and efficiency improvements for Parvis, marking a leap forward in the company's business practices. Introducing a scalable payment method has yielded tangible results across Parvis's operations.

Key Takeaways:

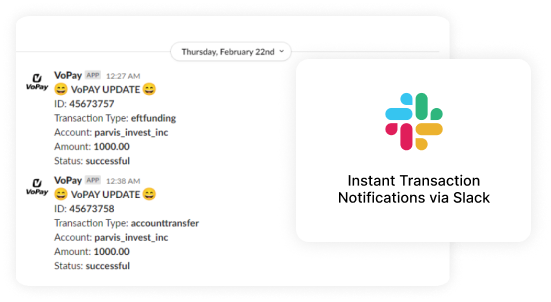

"From a cultural perspective, it has been amazing for our team. With VoPay’s advanced payment technology integration, we can literally see things the minute they happen. That is huge from an organizational standpoint—and not just from a financial perspective. Notifications from VoPay’s EFT solution have been integrated into a company Slack channel, bringing incredible visibility within our company."

Scott Spence, Head of Growth, Parvis

See How Fintech-as-a-Service Can Work For You

Get The Latest News In Fintech

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.