Rails

Use Case

Integration Time

Intro

FoodsUp, a leading online food service supply platform based in Toronto, has quickly become a go-to resource for over 8,500 medium and small restaurants across Ontario and Quebec. The company’s rapid rise, marked by a staggering 600% revenue growth over three years, is a testament to its compelling value proposition and operational excellence. A key factor in this success has been the strategic integration of VoPay’s Fintech-as-a-Service into FoodsUp’s core operations.

What sets this case study apart is how FoodsUp leverages VoPay’s financial technology to drive efficiency and innovation in the supply chain sector. In an online environment where speed and accuracy are crucial, having the right technology is not just an advantage—it's a critical necessity.

The Problem

1. Standing Out in a Competitive Market While Minimizing Operational Costs

In a traditional market dominated by conventional supply chain practices, FoodsUp set out to disrupt the status quo by operating online. While this approach offered a high-value alternative to established players, it also presented unique challenges. To gain a competitive edge, FoodsUp needed to identify efficiencies overlooked by competitors and implement scalable, online-specific solutions.

2. Costly Payment Solutions

Traditional payment methods were not aligned with FoodsUp's digital-first strategy and were expensive both in terms of direct costs and workforce time. Cash and cheques, which some customers still preferred, created disruptions in cash flow management and required manual processing, which was inefficient for an online platform. As a result, FoodsUp was primarily limited to credit cards as their sole online payment option.

3. High Transaction Costs

Credit card fees, often exceeding 2%, significantly impacted FoodsUp's profit margins. Unlike larger competitors such as Costco, which could reduce these fees through proprietary payment methods, FoodsUp had few options to manage these high costs, directly affecting their bottom line.

4. Limited Payment Flexibility

Relying solely on credit cards constrained FoodsUp and its merchants, offering them limited flexibility in payment options. This restriction not only affected operational efficiency but also hindered customer satisfaction by not accommodating diverse payment preferences.

5. Operational Strain and Inefficiency

Many FoodsUp customers continued to use cash or cheques upon delivery, which increased operational costs and reduced efficiency. Processing these payments manually took the finance team approximately three minutes per order. With over 900 orders daily, this led to nearly ten hours of low-value, labour-intensive work each day, diverting resources from more strategic activities.

The Solution

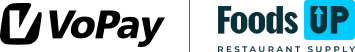

1. Authorization: Customers authorize a PAD agreement directly on the FoodsUp platform.

2. Bank Account Connection: Customers securely connect their bank accounts by entering their online banking information.

3. Tokenization and Recurring Payments: VoPay tokenizes the data and securely returns it to FoodsUp, enabling them to automate recurring payments seamlessly every time customers place an order.

The Results

"We are using VoPay’s financial technology to take that leap ahead. Competing with industry giants like Costco, especially when they have their own credit card solutions, requires a different approach. You need to differentiate yourself in terms of product, price, service, and offerings. For us, VoPay’s financial technology has been the key to gaining a competitive edge."

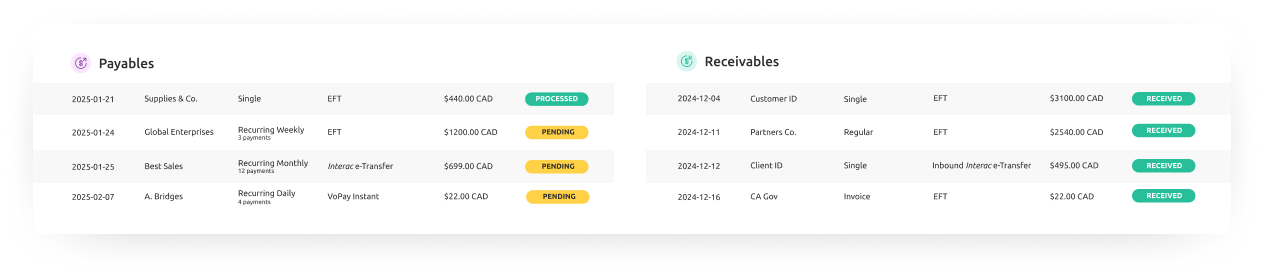

Charley Chen, CFO, FoodsUp3.2 million dollars is processed using elinx and Pre-authorized debit bank account payments, eliminating $64,000 in transaction fees.

"Because VoPay supports all kinds of APIs, we were able to do some amazing things."

Charley Chen, CFO, FoodsUpSee How Fintech-as-a-Service Can Work For You

Get The Latest News In Fintech

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.