Use Case

Integration Time

Intro

For over 15 years, this Canadian lender* has specialized in financing for customers with credit challenges, helping them purchase furniture easily. Founded in 2006, the company quickly became a favourite due to its fast turnaround times and flexible lending options. The company has doubled in size, assisting thousands of consumers with their financing needs.

However, with the sharp increase in new kinds of lenders in the market and a need to stay ahead of the curve, the company began exploring new avenues to maintain its competitive edge, deliver the customer service it was known for, and cut down on costs.

To address these challenges, they turned to VoPay’s Fintech-as-a-Service platform. This case study details how VoPay’s platform transformed the lender’s operations and increased productivity by 25%.

The Problem: The True Cost of Manual Processes

The alternative lending space in Canada is growing rapidly, with the market expected to surge from US$1.48 billion in 2022 to US$4.20 billion by 2027. Online lenders have become a popular and efficient method for Canadians to secure quick funding. However, the industry is highly competitive, with nearly half of borrowers researching multiple lenders before applying. Differentiation in service and efficiency is crucial.

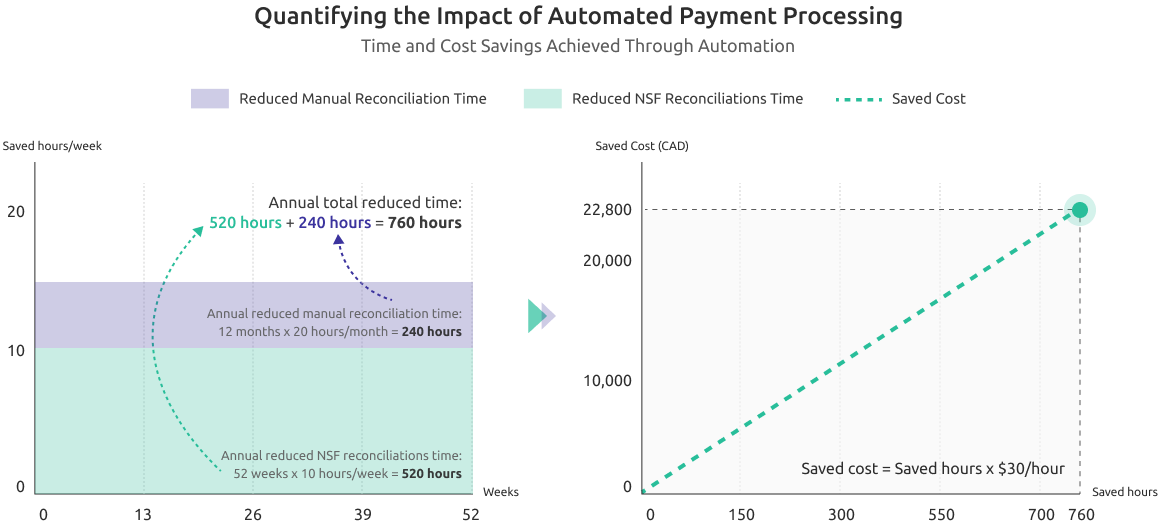

This organization faced significant challenges due to outdated manual payment processes, which resulted in high operational costs and wasted valuable employee time. Manual payment data entry, NSF reconciliation, and correcting clerical errors consumed a substantial 25% of their workforce hours.

Lenders cannot afford the thousands of dollars lost annually due to labour inefficiencies and human errors, which substantially reduce their profitability.

“Before automation, the process was archaic. We would send a list, and someone would manually enter every payment into the system. Our supervisors would spend between one and a half to four hours completing NSF reconciliations every Monday morning. It’s hard to believe this is still common practice in the industry.”

- Company CEO6 Key Issues Faced By The Organization

1. High Operational Costs and Inefficiencies: Manual payment processes increased labour costs and ineffective resource use. The organization needed a solution to address and minimize these operational costs.

2. Human Errors: The current system increased the likelihood of errors due to manual data entry, leading to further inefficiencies and additional correction costs.

3. Lost Productivity: Employees were spending a large amount of time on low-value tasks instead of focusing on strategic, high-impact activities.

4. Need for Real-Time Payments: Delays in fund disbursement affected customer satisfaction. Real-time payouts were essential to ensure immediate and secure disbursement of funds.

5. Integration Challenges: The organization needed a developer-friendly API for easy integration with existing systems, enabling seamless operations and efficient automation.

6. Automated Fund Disbursement and Bulk Collections: To further streamline operations, the lender needed automation in collections and fund disbursements to ensure error-free transactions and improve overall efficiency.

The Solution: Whoever Funds Fastest Wins

The lender’s primary objective was to simplify the customer journey by minimizing client information requirements, reducing manual input, and eliminating unnecessary human involvement post-approval.

During initial discussions with VoPay CEO Hamed Arbabi, the lender quickly recognized the alignment between their needs and VoPay’s capabilities. The simplicity and effectiveness of VoPay’s payment platform were immediately evident.

“What I loved was that even before discussing with Hamed Arbabi, I quickly identified what they did, how it would work for us, and its simplicity in API integration. It fit the bill and checked all our boxes.”

- Company CEOThe Results: Quantifying the Qualitative

VoPay’s expertise in payment technology completely overhauled the lender’s collection and disbursement processes, simplifying operations, reducing manual work 25%. By integrating VoPay’s solutions, the lender saved time and costs, achieving a 30% reduction in labour costs, and scaled operations efficiently. This automation set the stage for sustainable growth and provided a competitive edge in the market.

Outcomes Achieved

Operational Savings

“To be quite frank, the cost-saving has been huge. Whether it’s money, time, or staff, the reduction in the time it takes to address issues arising from payment processing has been remarkable.”

- Company CEO* This case study is based on a real lending organization. However, to respect the privacy of our clientele, the organization has been kept anonymous.

See How Fintech-as-a-Service Can Work For You

Get The Latest News In Fintech

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.