Use Case

Integration Time

Intro

Wagepay, a leading Earned Wage Access (EWA) provider in Australia, has rapidly grown since its founding in 2020, serving over 310,000 users and processing more than $180 million in advances. As they looked to expand internationally, starting with the Canadian market, Wagepay encountered challenges related to unfamiliar payment systems, varying provincial regulations, and maintaining real-time wage access for their users.

To navigate these complexities, they needed more than a typical payment processor. They required a strategic partner capable of delivering an end-to-end solution—one that could match the reliability of Australia’s payment infrastructure while adapting to Canada’s unique financial landscape.

That’s where VoPay stepped in. With its full-stack Fintech-as-a-Service platform, VoPay provided the expertise and technology to enable Wagepay’s successful expansion into Canada.

The Problem

"For many industries looking to enter the Canadian market, particularly in the financial sector, the barrier to entry can be significant. It’s not that the process is overly complex, but the market’s size often doesn’t justify the full effort required by global players to go it alone."

Hamed Arbabi, VoPay Founder and CEOWhile Canada and Australia might share many similarities, their financial systems operate under markedly different frameworks. These regional differences, while expected, introduced an additional layer of complexity for Wagepay, including:

1. Maintaining Real-time Payout Capabilities

When expanding into Canada, Wagepay encountered an entirely different payment landscape. In Australia, the New Payments Platform (NPP) supports instant, 24/7 bank transfers, but Canada's systems lacked the real-time capabilities essential for Wagepay's wage disbursement model. To ensure compliance with Know Your Customer (KYC) regulations, prevent fraud, and maintain full control over payments, Wagepay required instant bank account payment technology with easy onboarding, secure tokenization of sensitive banking information and bank-level security.

Complicating matters further, Electronic Funds Transfers (EFTs) in Canada can take 3-4 business days to process, hindering Wagepay's ability to offer immediate wage access. These delays challenged their commitment to fast, automated wage disbursements.

2. Regulatory Complexity

A major challenge in expanding into Canada was navigating the country's fragmented regulatory landscape. Unlike Australia's unified framework, Canada’s financial regulations vary by province. Operating in British Columbia and Ontario required Wagepay to manage different requirements, particularly around Know Your Customer (KYC) protocols and account validation.

These regional differences added complexity to Wagepay’s operations, requiring a tailored approach to ensure compliance while maintaining operational efficiency across provinces.

3. Lack of Payment Automation

Wagepay’s business model depends on full automation, allowing it to process large volumes of payouts without manual intervention. However, they faced a significant challenge when expanding into Canada: the country’s payment systems required manual processes that clashed with their automated operations. Slower payment confirmations, file uploads and extended EFT timelines would drastically reduce efficiency, limit scalability, and diminish the user experience. For Wagepay, incorporating manual steps wasn’t just inconvenient—it threatened the very foundation of their business model.

"We’ve always operated with full automation—it’s the core of our business. In fact, 99% of our processes are automated. So, it was crucial for us to partner with a company like VoPay that could meet and maintain those high standards. VoPay has been able to keep up with our automation needs, which has been essential for us to continue delivering efficient and reliable service to our users."

Tony Chan, CFO, WagepayThe Solution

VoPay’s deep understanding of the local financial ecosystem and its embedded payment solutions allowed Wagepay to successfully establish its presence in Canada, positioning the company for further global expansion.

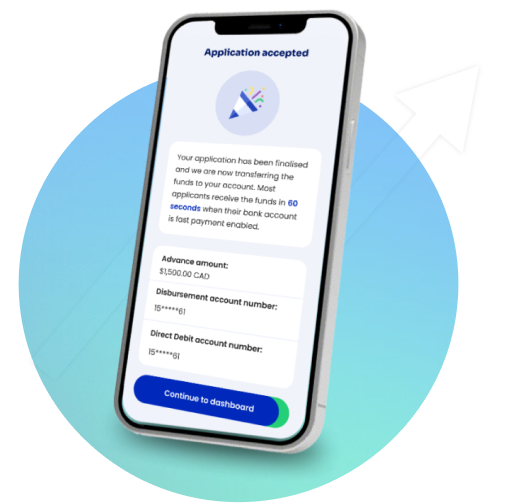

VoPay Instant, a push-based Electronic Funds Transfer (EFT) solution, provided Wagepay with real-time payment capabilities 24/7. This enabled Wagepay to process wage disbursements rapidly, depositing funds into customer bank accounts within one to 30 minutes. This was vital to maintaining Wagepay’s reputation for speed in Canada’s slower payment ecosystem, ensuring no disruptions to their real-time wage access model.

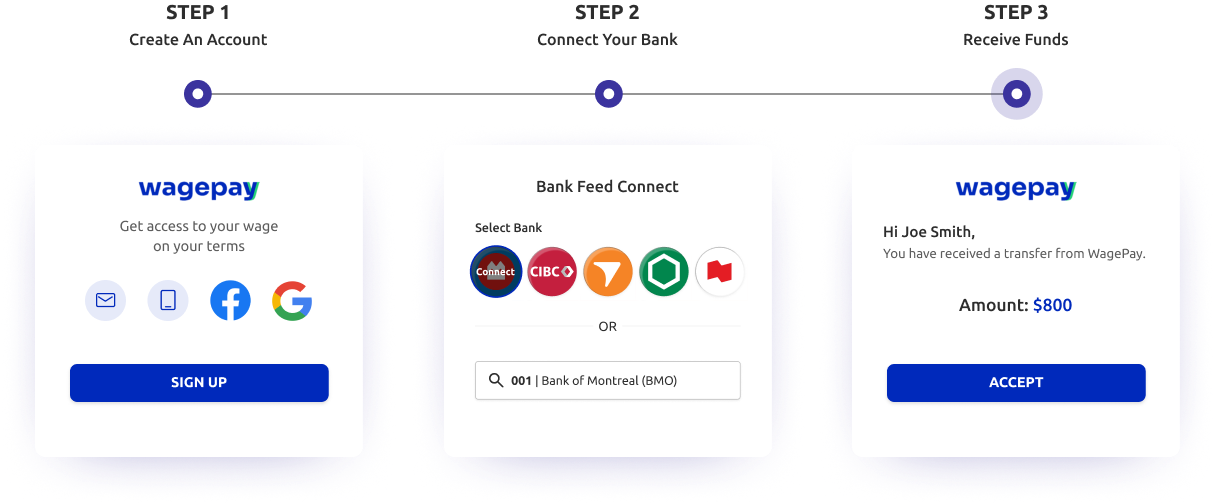

eLinx Connect was pivotal to Wagepay’s business model by automating high-volume transactions and eliminating the need for manual intervention. The solution securely collects and tokenizes customer bank account details, facilitating the Know Your Customer (KYC) process and ensuring compliance with Canada’s diverse provincial regulations. This automation reduces administrative overhead, minimizes errors, and safeguards sensitive customer data, allowing Wagepay to maintain full regulatory compliance while operating efficiently across multiple regions.

By embedding VoPay’s payment infrastructure into its solution, Wagepay gained the payment automation features it needed to handle large transaction volumes with complete efficiency.

Key features include:

1. Transaction Monitoring

Every transaction is logged and categorized in real-time, providing complete visibility into all payment activities as they occur.

2. Automated Data Matching

For reconciliation, the system automatically cross-checks transactions against external records, ensuring each payment is accurately recorded and matches the expected amounts.

3. Error Detection and Resolution

The system immediately flags any discrepancies, such as missing payments, duplicates, or incorrect amounts, enabling swift resolution without the need for manual oversight.

4. Real-Time Status Updates

Wagepay benefits from continuous, real-time updates on payment statuses, ensuring they remain informed at all times without manually tracking each transaction.

5. Automated Reporting

The system generates comprehensive, automated reports on transaction statuses and account balances, significantly simplifying the financial reporting process and reducing manual workload.

By partnering with an end-to-end automated payment solution like VoPay, Wagepay was able to break into the Canadian market with a scalable solution to deliver secure, real-time wage access to its users.

How It Works

The Results

With VoPay’s embedded payment infrastructure, Wagepay successfully entered the Canadian market and established itself as a key player in the Earned Wage Access space. The results speak for themselves.

Successful Market Expansion with VoPay

Wagepay’s expansion into the Canadian market, facilitated by their partnership with VoPay, was a significant success, overcoming the complexities of entering a new market with different regulatory and payment challenges. Key results of this expansion include:

1. Overcoming Regulatory Hurdles:

With VoPay’s in-depth knowledge of Canada’s payment landscape, including expertise in navigating provincial and federal financial regulations, Wagepay was able to enter the Canadian market within weeks while being assured that its operation was compliant with all regulatory requirements, avoiding any major regulatory delays.

2. Establishing Market Leadership:

Wagepay quickly established itself as a leader in Earned Wage Access (EWA) in Canada, gaining a competitive edge by offering faster and more reliable wage disbursements. This market leadership was solidified through VoPay’s end-to-end payment solution, which ensured speed, security, and compliance.

3. Foundation for Future Expansion:

With VoPay’s scalable payment infrastructure, Wagepay is now positioned to expand across additional provinces in Canada and has the potential for further international growth including cross-border payment in the US. The fast and reliable integration of VoPay’s technology has laid a strong foundation for sustained success and scalability.

4. Efficient, Automated Financial Operations:

By automating core processes, Wagepay has the ability to scale rapidly and serve a growing user base without escalating operational costs. These savings were passed on to users, boosting customer satisfaction and improving retention rates.

5. Real-Time Wage Payouts:

Wagepay is now able to provide real-time wage disbursements, maintaining its core promise of fast, reliable access to wages—critical for customer satisfaction and retention.

"Serving tens of thousands of users requires smooth, 24/7 operations, and VoPay delivered the reliable, automated payment infrastructure we needed. We charge nearly half the fees of traditional payday lenders in Canada, and we’re committed to reducing them even further. By leveraging automation and risk management, we eliminate overhead costs that most competitors can’t avoid. Payments are the backbone of our business, and a two- or three-day delay would destroy your business model. Partnering with VoPay was essential."

Tony Chan, CFO, WagepaySee How Fintech-as-a-Service Can Work For You

Get The Latest News In Fintech

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.