Advanced ACH Payment Processing In Canada & The US

Connect to North America’s biggest bank account payment network using our dedicated Payment Portal and API integration.

Start processing ACH transfers with flat-rate transaction costs that let you push or pull ACH payments at scale.

See How Much You Could Save With Bank Account Payments:

Credit Card Cost

VoPay ACH Cost*

1.5%

3.5%

Credit Card Rate

ACH Payments For Any Industry

Our integration recipes are designed to give enterprises in any industry the tools to start processing ACH transactions as quickly as possible.

Faster earned wage access for workers to keep them loyal to your platform.

Low-cost deposits and collections to streamline your lending payments.

Handle large payments with ease and speed up cash-flow with faster payments.

Move money between US bank accounts with speed, efficiency and control.

Better recurring billing and reduced transaction fees for digital platforms.

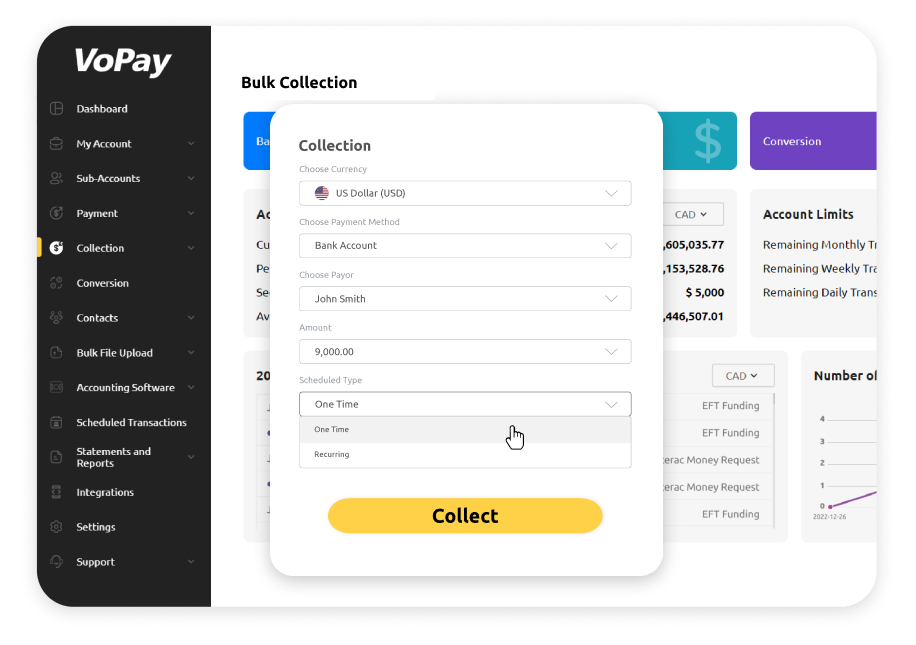

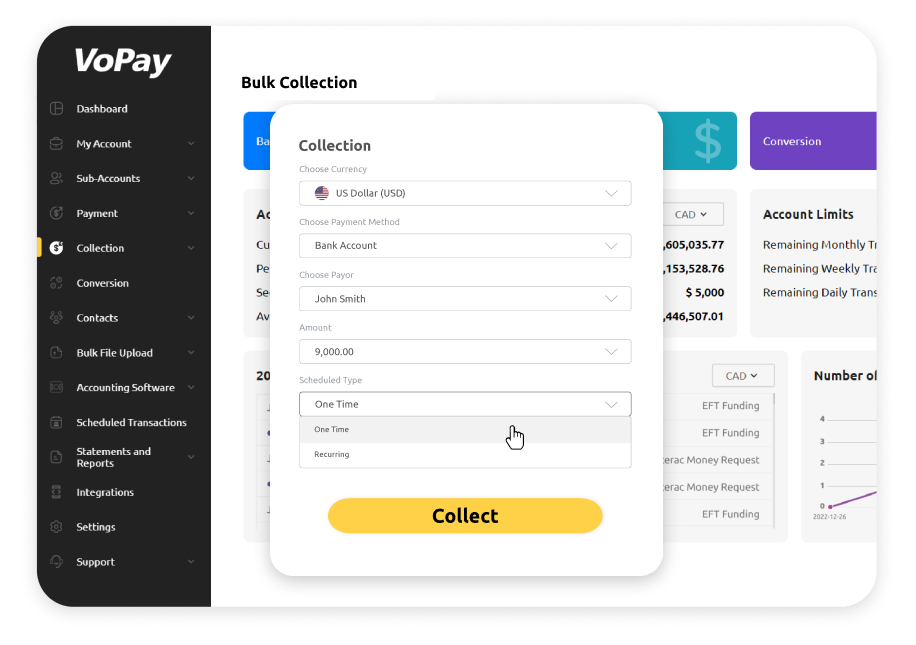

Dedicated Payment Portal For ACH Transfers

Our user-friendly interface makes it easy to get started with ACH payment processing with a centralized view of your funds and transactions.

You can easily manage your transactions, view your account balances, access detailed reporting and analytics to gain valuable insights into user behavior.

Frequently Asked Questions

Speak to a Fintech Advisor Today!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.

VoBot

VoBot

I’m VoPay’s AI assistant,

how can I help?

Click here to return to VoBot.