Canada’s Most Flexible Interac e-Transfer® API For Business Payments

Get access to Canada’s favourite payment method with Interac e-Transfer® fully optimized for business use on the VoPay platform.

Send and receive unlimited Interac e-Transfers with commercial limits of up to $25,000. Automate your payments with bulk collection capabilities.

See How Much You Could Save With Interac e-Transfer For Business:

Credit Card Cost

Interac e-Transfer Cost*

1.5%

3.5%

Credit Card Rate

Interac e-Transfer Payments Processed On The VoPay Network

Processed In Interac e-Transfer Transactions (CAD)

Interac e-Transfer Payments For Any Canadian Business

Our integration recipes are designed to give Canadian industries the tools to build Interac e-Transfer payments into their products and services quickly and easily.

Simple earned wage access using just an email address for instant deposits.

Let customers choose Interac e-Transfer for loan payouts and increase revenue.

Build hassle-free rent collections into your platform with Interac e-Transfer.

Move money between accounts with bulk file uploads and lower costs.

Pay and get paid on your platform using Canada’s favorite payment method.

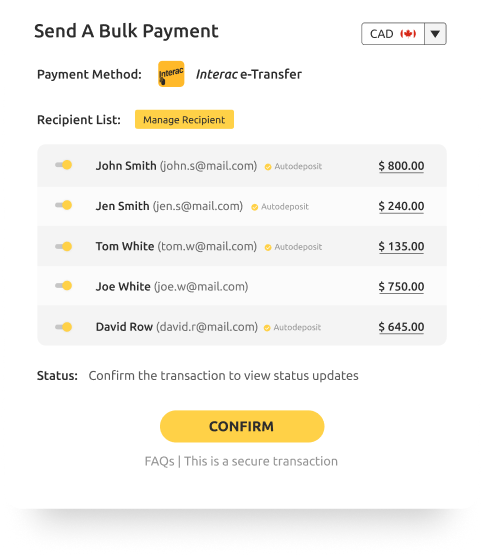

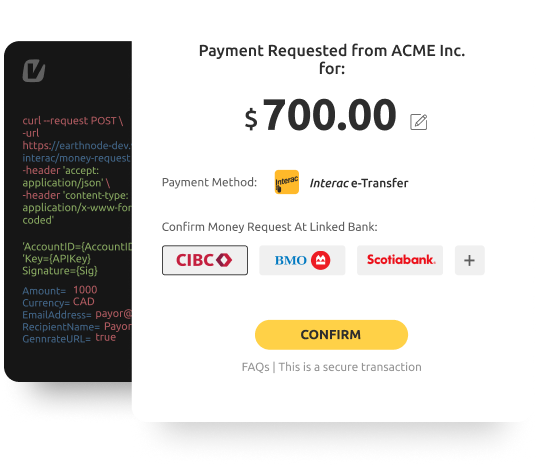

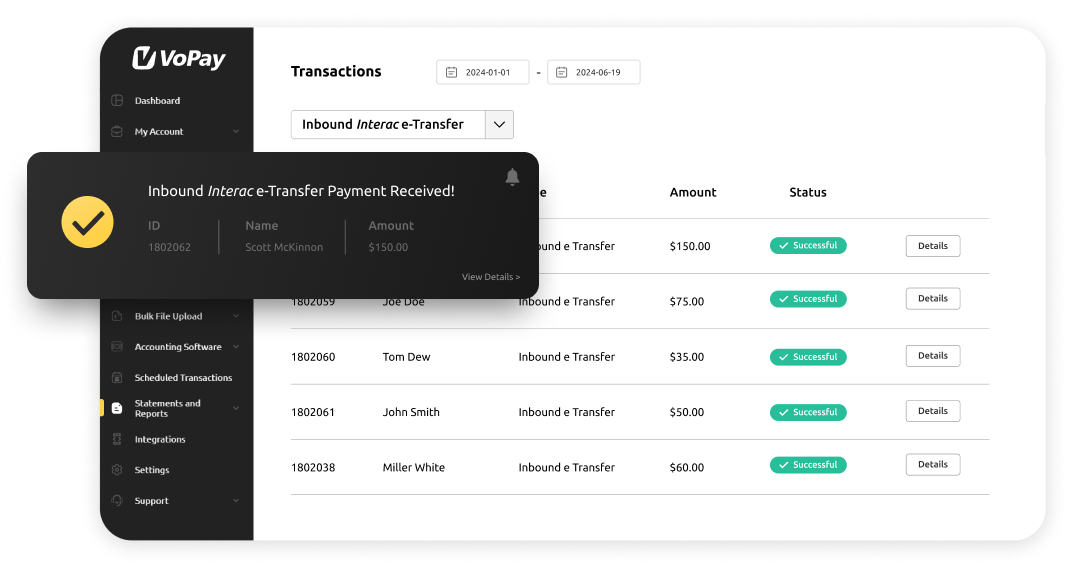

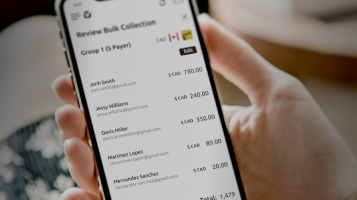

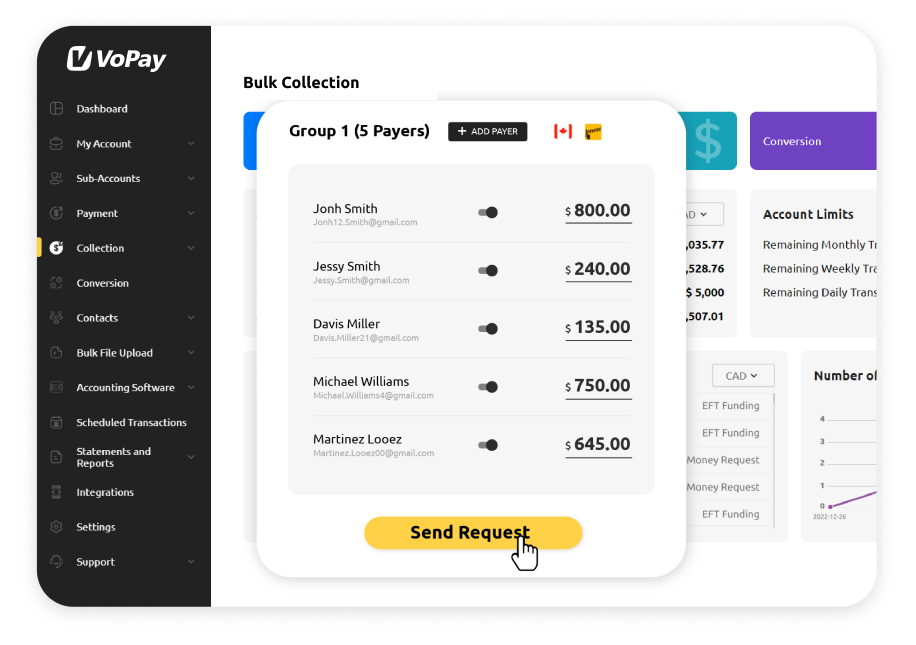

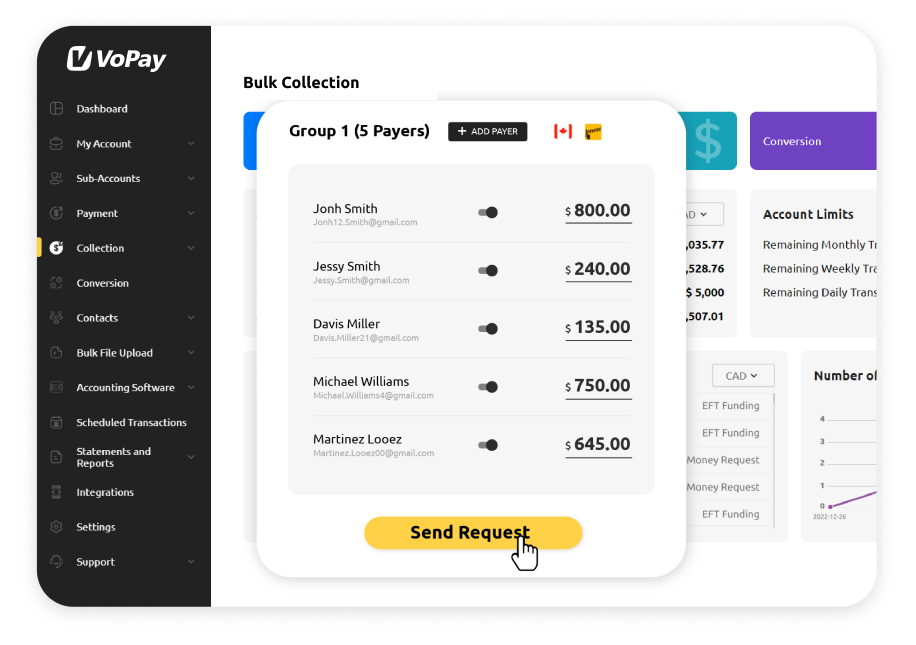

Send & Collect Bulk Payments From Our Portal

Manage Interac e-Transfer for business payments with confidence from our dedicated no-code Payment Portal that gives you access to the same powerful tools as our API.

Create bulk Interac e-Transfer collections and monitor the status of your transactions from start to finish for complete understanding of your transactions.

Interac e-Transfer FAQ

Speak to a Fintech Advisor Today!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Onboarding Support

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Speak To Our Team

Speak to a Fintech Advisor to outline your needs and impact plan.

Access Sandbox

Start testing in the VoPay sandbox to explore our advanced API functions.

Sign & Onboard

Our compliance and onboarding team will guide you through the process.

Go Live!

Choose a production date and launch your integration with confidence!

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.

VoBot

VoBot

I’m VoPay’s AI assistant,

how can I help?

Click here to return to VoBot.