Rails

Use Case

Integration Time

Intro

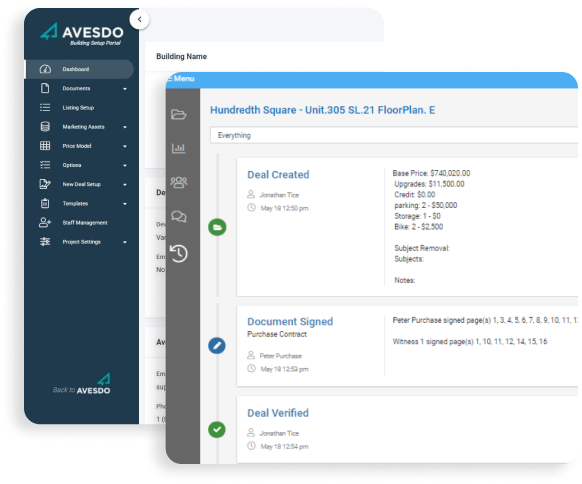

A leader in real estate technology, Avesdo provides specialized Transaction Management Software (TMS) that streamlines the selling and sale of new homes. Trusted by hundreds of developers and handling billions in transactions annually, Avesdo identified a critical industry challenge: the inefficiency of new home real estate transaction processes.

This case study explores how Avesdo strategically integrated VoPay's advanced payment solutions to address these pervasive inefficiencies and improve its market position.

The Problem

Core Challenges Identified

1. User-Centric Payment Inefficiencies

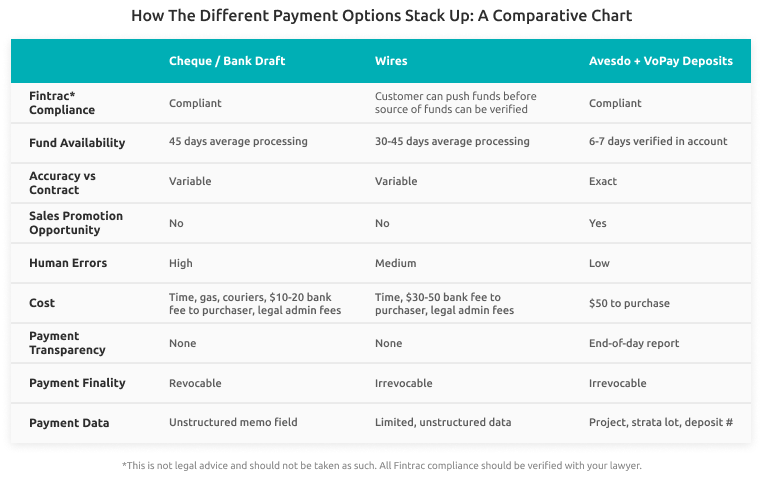

Traditional payment methods such as cheques and wire transfers cause significant challenges for real estate developers. These outdated methods lead to prolonged payment reconciliation periods of up to 45 days, cause massive headaches, and impose a heavy administrative burden.

2. Cost and Capacity Barriers

While the platform's initial credit card solution was sufficient for the initial $5,000 deposit, its use became problematic for larger real estate installment deposits due to prohibitive processing costs and transaction limits. These limitations made credit card payments impractical and hindered the platform’s ability to allow developers to manage large real estate transactions at scale.

3. Limited Market Reach

Avesdo’s business model primarily targeted developers, which, while initially effective, limited its potential for broader market engagement. Focusing exclusively on one customer segment restricted opportunities for growth and innovation across the broader real estate transaction market, thus constraining its overall market reach and revenue capabilities.

The Solution

Avesdo wanted a digital-first approach to respond to these challenges and amplify its market standing. By partnering with VoPay, Avesdo improved service efficiency and established itself as the preferred platform for developers, ensuring a superior user experience in the competitive new home sales market.

By integrating with VoPay’s payment technology, Avesdo can offer users much more, strengthen its competitive advantage, and expand its market share.

VoPay’s Advanced EFT and Digital Pre-Authorized Product

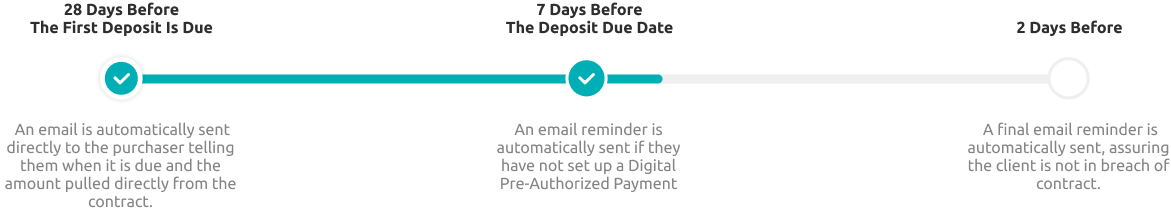

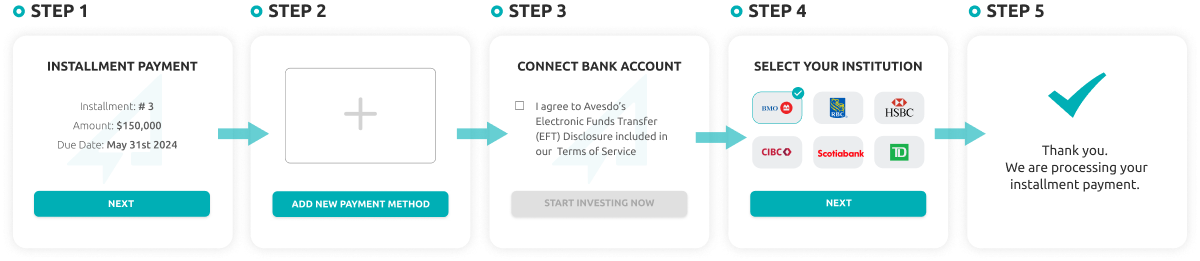

VoPay’s EFT product delivers a robust and secure solution for electronic funds transfers, designed specifically for business applications like Avesdo’s real estate transaction management. Using VoPay’s proprietary eLinx payment technology, a link is sent directly to purchasers to simplify the process of capturing bank details securely. This method reduces input errors and employs advanced tokenization to protect sensitive data. Each link is unique, tailored to its recipient, enhancing the traceability and security of each deposit.

Seamlessly integrated into Avesdo’s platform, this ensures transactions are traceable and automated with real-time notifications for transparency. Key security features like fraud detection and multi-factor authentication safeguard against threats, ensuring compliance and reliability in high-stake real estate transactions.

How It Works

For The Purchaser

For The Developer

Integrating VoPay’s EFT solution, Avesdo has enhanced the platform, delivering unprecedented financial efficiency. With this system, bank account payments are processed—pulled, cleared, matched, and reconciled—in six days or less, allowing developers to process construction draws faster than ever before.

“As a real estate developer, we love it. While deposits are officially contractually obligated payments, up until this point, we have always been on the defence, chasing and trying to get purchasers to do it. With Avesdo’s payment integration it puts us on the offence. We aren’t spending time chasing trying to get them to do something they are contractually obligated to do.”

- Avesdo platform userThe Results

A Superior and Unmatched End User Experience In New Home Sales

Integrating VoPay’s advanced EFT solution, Avesdo has enhanced the platform, delivering unprecedented deposit payment efficiency. With this system, bank account payments are processed—pulled, cleared, matched, and reconciled—in six days or less, allowing developers to access construction draws faster than ever before.

“We didn’t know how long it was taking us to process and reconcile cheques and wire transfers until we saw the immediacy of EFTs.”

- Avesdo platform user

Market Expansion and Revenue Growth through Payment Partnership

“It is interesting to see how truly seamlessly it has worked right out of the gate.”

- Ben Smith, President, Avesdo"By digitizing the payment, we can automate so many new things that were previously manual. This opens up a whole new channel for us and creates a new revenue stream. For us, this is just the beginning. With payments integrated into our system, we see a variety of product and feature enhancement opportunities to explore that will help us serve our customers even better and deliver on our promise to help them sell more homes faster, for more money with less risk."

- Ben Smith, President, AvesdoSee How Fintech-as-a-Service Can Work For You

Get The Latest News In Fintech

Get to know the VoPay API

Get access to our developer friendly API and get a feel for how our payment solutions work.

Request a Call

Talk with our sales team

We are happy to answer your questions. Fill out the form and we will have one of our team members contact you.